CNBC-TV18

@CNBCTV18Live

The CNBC-TV18 news ticker on Twitter. The news breaks here first.

ID:44839509

http://www.cnbctv18.com 05-06-2009 06:48:11

989,2K Tweets

1,2M Followers

534 Following

Follow People

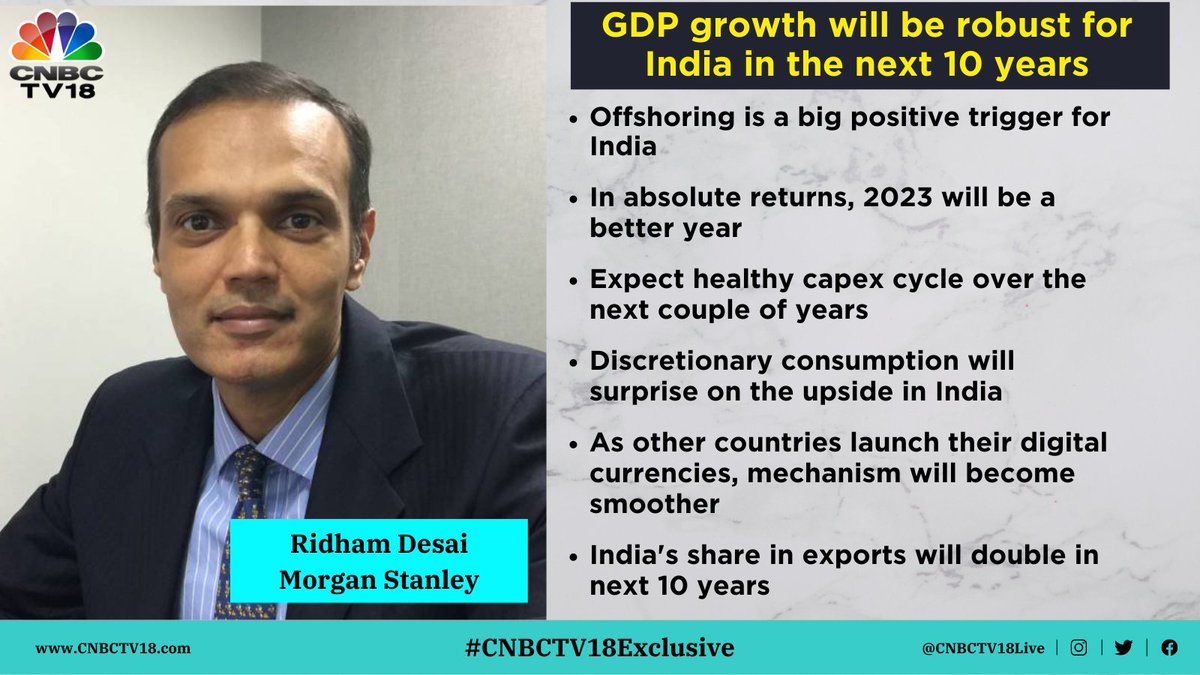

Why this could be India’s decade Morgan Stanley Ridham Desai Ridham Desai lists Three big pillars

1. Offshoring - India is becoming office & factory to the world

2. Indiastack as a public utility

3. Energy change #OnTheRecord #India #CNBCTV18Market

Discretionary consumption will surprise on the upside in India. Effective social distribution using technology has been a key factor for the political success of the BJP says Morgan Stanley Ridham Desai Ridham Desai #OnTheRecord #India #CNBCTV18Market

Themes, sectors to bet on over the decade based on Morgan Stanley bull case on #India says Ridham Desai Ridham Desai

1. Banks & financials

2. Consumer discretionary

3. IT services

4. Industrials including defence

#OnTheRecord | #GDP growth will be robust for #India in the next 10 years. Hope that there is no negative surprise in 2024 #elections , says Ridham Desai (Ridham Desai) of Morgan Stanley (@MorganStanley) in a #CNBCTV18Exclusive interview with Shereen Bhan

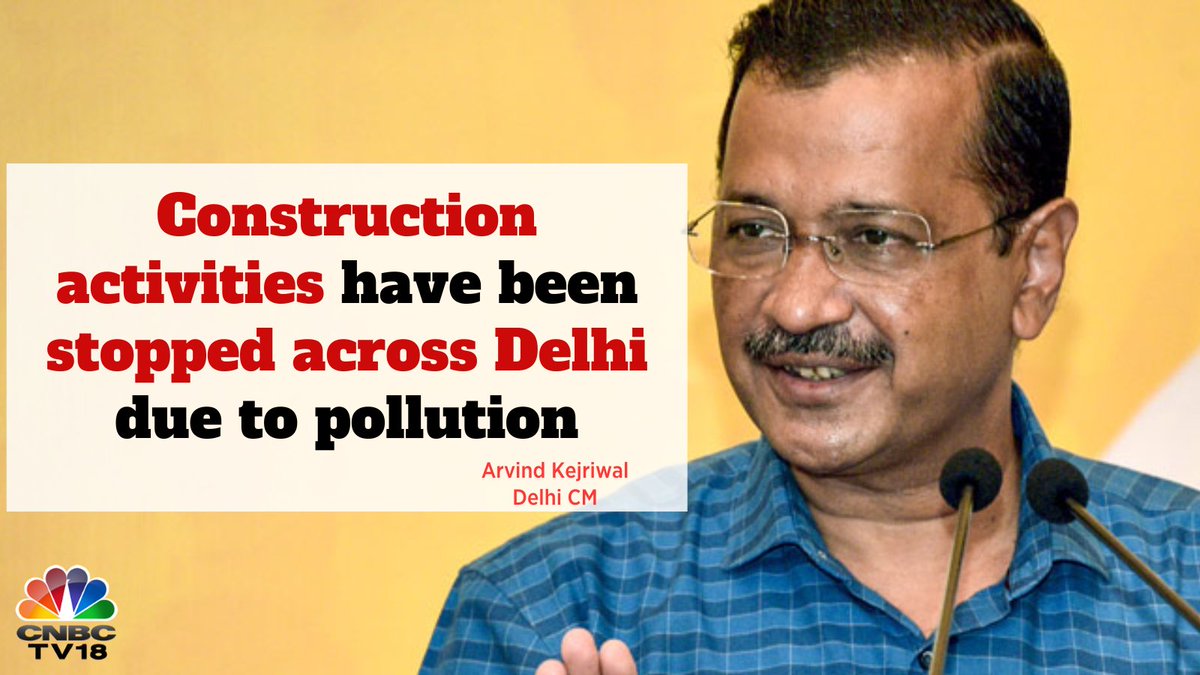

#Construction activities have been stopped across #Delhi due to pollution, says Delhi CM Arvind Kejriwal

#ArvindKejriwal

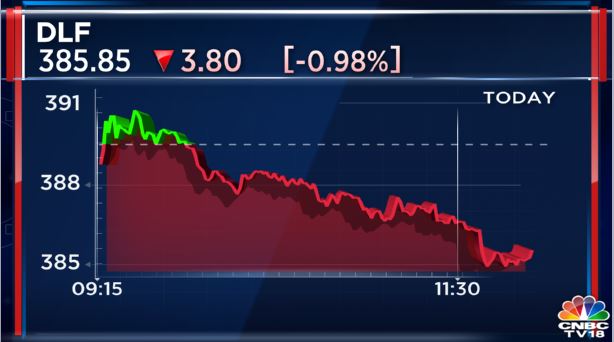

#CNBCTV18Market | DLF in focus

Construction activities have been stopped across Delhi due to pollution: Delhi CM

#2QWithCNBCTV18

Karnataka Bank

Asset quality – QOQ

Slippages at Rs303cr, down 46.8%

GNPA ratio at 3.36% vs 4.03%

NNPA at 1.72% vs 2.16%

PCR at 49.9% vs 47.4%

Restructured book at 6.22% vs 7.37%

Biz momentum:

Deposits at Rs81634cr, up 6.13%YOY & 1.31%QOQ

#2QWithCNBCTV18

Cholamandalam: Strong business momentum, doesn’t translates to P&L growth

Disbursals a Rs14623cr, up 68%YOY & 9.7%QOQ

AUM at Rs91841cr, up 22.35%YOY & 5.9%QOQ

Operating profits at Rs1040.3cr, up 16.8%YOY & down 2.1%QOQ

NIM at 7.6% vs 7.7%YOY & vs 8%QOQ