Keith McCullough

@KeithMcCullough

CEO, Hedgeye Risk Management

ID:18378349

http://www.hedgeye.com 25-12-2008 19:38:54

256,6K Tweets

261,4K Followers

960 Following

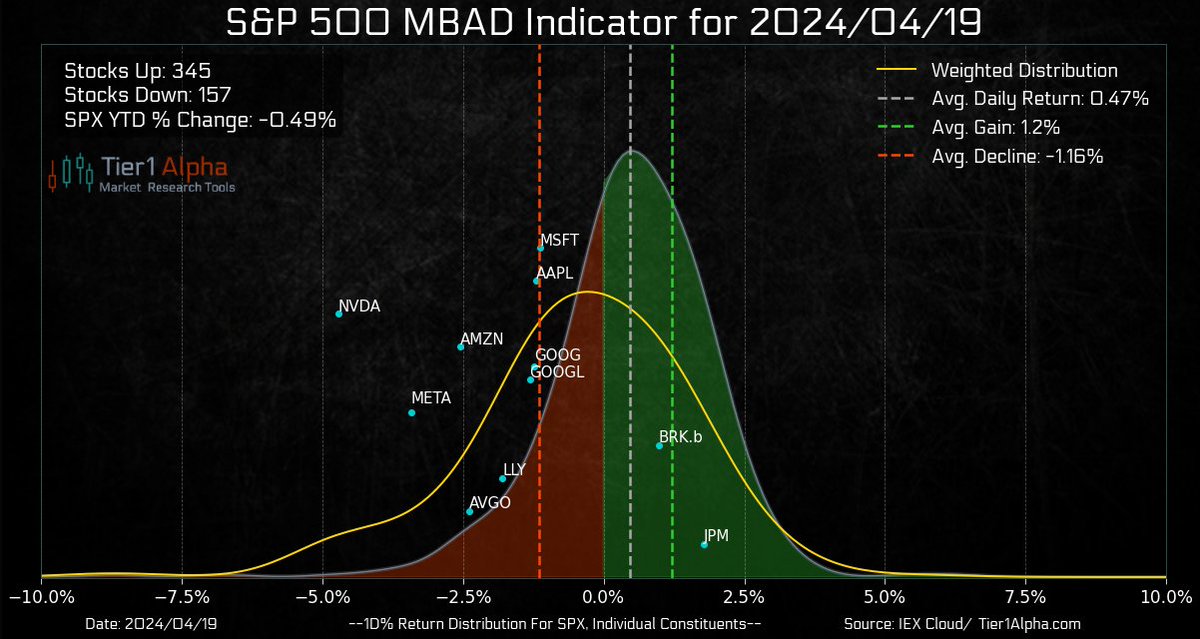

Keith McCullough Easily my most satisfying day as a Portfolio Solutions subscriber. Nasdaq down 2%+, people whining, but my portfolio is in the green after loading up on energy, oil, commodities early in the week (and trimming areas where signal is weakening).

Yep. Credit to my All-Pro Analysts, Jay Van Sciver Jay Van Sciver (The Bear on $TSLA) and Fernando Valle Fernando Valle, CFA (The Bull on $XOM)

*See our evolved INVESTING IDEAS product for these longer-term Longs and Shorts

Keith McCullough Hedgeye Keith is 100% correct. Being flexible and having a go anywhere strategy is key. Keith reduced exposure last week and put the redeye app on snooze last week. I went mostly cash except some energy and commodities exposure and finished up this week. Keith I even added the NatGas

Rule #1 = don't lose money

Rule #2 = when you're losing, don't lose alongside the crowd

Rule #3 = #GoAnywhere , any Asset Class, anytime

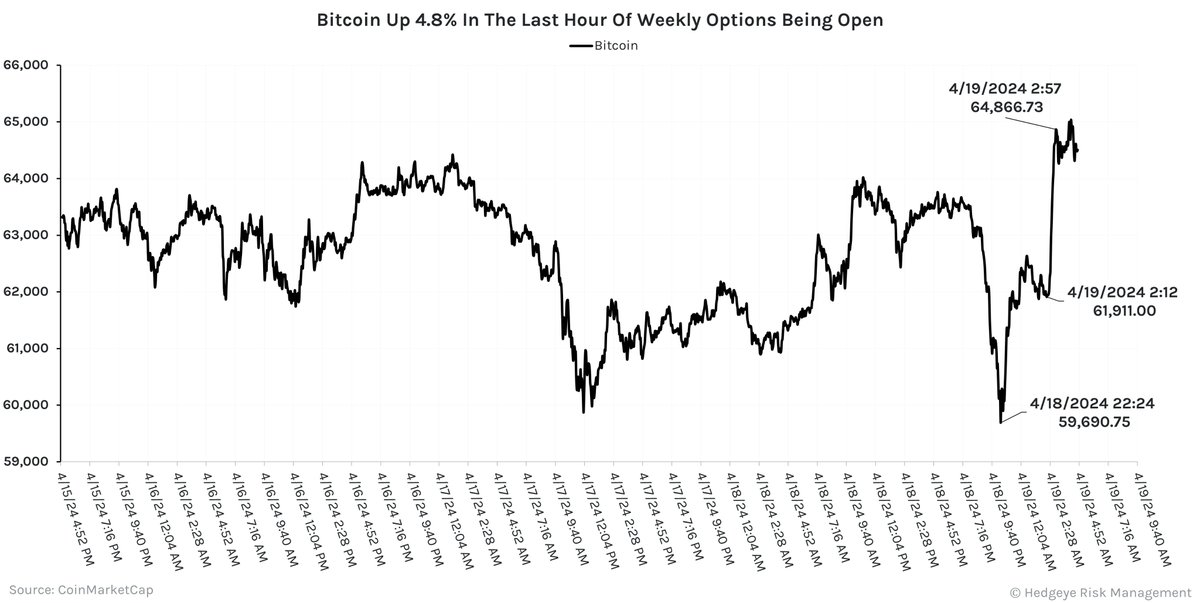

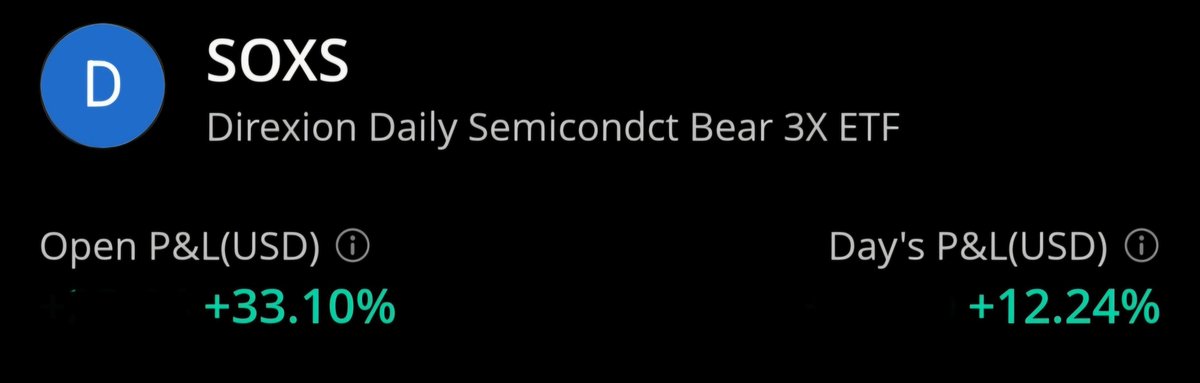

Been watching the $SOXS for a while now, implementing #theprocess , waited with as much patience and as few feelings as possible. Just observed the relevant levels and when Keith McCullough began explaining the breakdown in semis (and in particular the leaders of semis), I scaled

Keith McCullough He's not lying, using many of the same core portfolio positions my account has been in the green 2 or 3 days this week while the indexes have been getting drilled.

Puru Saxena Bro, where is the gold? Where are the commodities? Where are the treasuries? Where is the energy?

This is what diversification is. You're exposed to a tiny sliver of the market, all tightly correlated together.

Keith McCullough could teach you a thing or two about a truly

The MFO (Mucker Fam Office) Long Only account closed UP today in a sea of $SPY Monkey red

Do you have a modern day #GoAnywhere Asset Allocation Strategy? Why not?

If you were Long Insurance, Shipping, and Energy like #HedgeyeNation was, you're not panicking

Nik “The Carny” Lentz DCP Discovery Trading Group GTC Traders James Jude Andy Constan Nik if you're truly looking for an education follow Keith McCullough Hedgeye and their analysts. They set up an online university to help build your own process. app.hedgeye.com/education When you're done buy the MacroShow and The Call to start and then build with more.

Quad/Vasp Addict cozy country club Agree. You don’t have to do everything Keith McCullough does. More important is to study and understand what is being talked about day to day take notes and study them. Watch Hedgeye live convos and take notes. Lots of alpha to decipher from high level players.