Liz Ann Sonders

@LizAnnSonders

Chief Investment Strategist, Charles Schwab & Co., Inc. Disclosures: https://t.co/UPkjXSZ9uc

ID:2961589380

http://schwab.com/ 06-01-2015 23:33:53

23,3K Tweets

325,6K Followers

648 Following

Our own Kevin Gordon is appearing momentarily on TD Ameritrade Network with Nicole Petallides live from #SchwabIMPACT

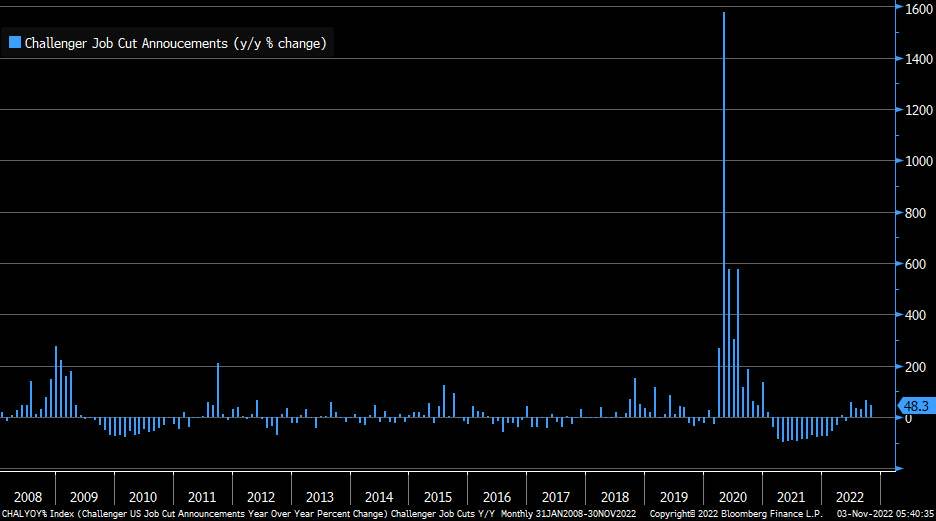

October ChallengerGray job cut announcements +48% y/y vs. +68% in prior month … fifth consecutive month of increases; Tech saw most announced cuts at 5.3k, followed by warehousing (2.5k) and services (1.8k)

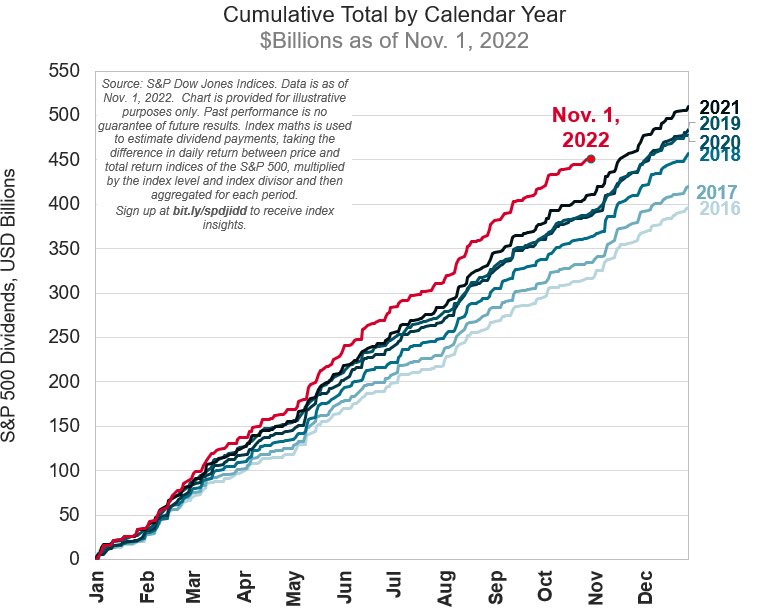

S&P 500 Dividend Aristocrats have 10% outperformance YTD; continued strength & diversification in earnings has helped dividends to remain firm & 2022 is on well on track to mark new high for total dividends paid by S&P 500 constituents

S&P Dow Jones Indices

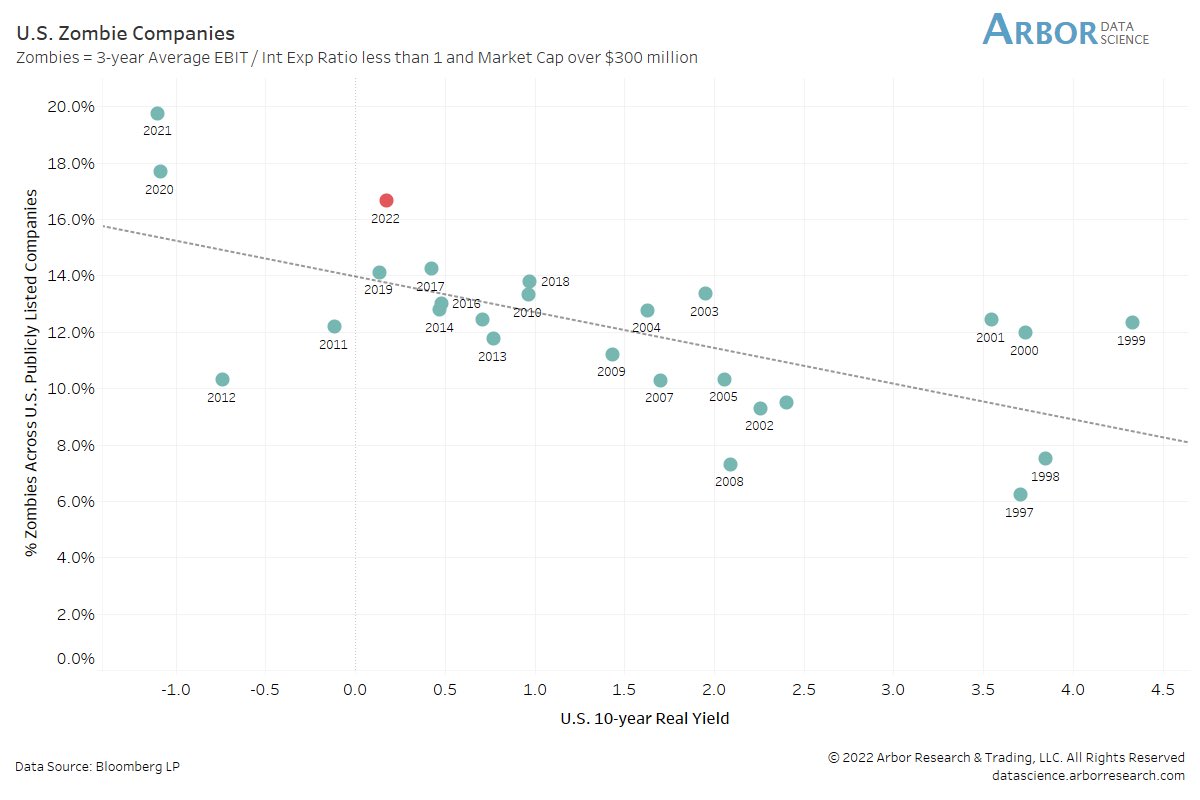

Historical pattern holding firm this year (red dot) as rise in 10y real yield has coincided with fewer zombie companies

Arbor Data Science Bloomberg LP

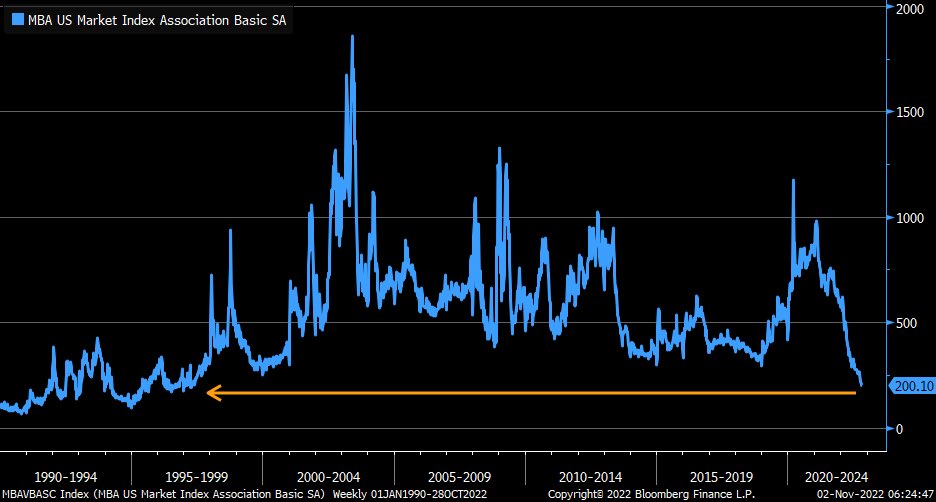

Path of least resistance for mortgage demand continues to be down … Mortgage Bankers Association index now at lowest since early 1997

![Liz Ann Sonders (@LizAnnSonders) on Twitter photo 2022-11-03 11:11:33 Yesterday’s peak-to-trough % drop wasn’t as bad for Dow (shedding nearly 1000 points) but still quite something [Past performance is no guarantee of future results] Yesterday’s peak-to-trough % drop wasn’t as bad for Dow (shedding nearly 1000 points) but still quite something [Past performance is no guarantee of future results]](https://pbs.twimg.com/media/Fgoo2CLUAAAQnFx.jpg)

![Liz Ann Sonders (@LizAnnSonders) on Twitter photo 2022-11-03 11:10:58 Fed day proved (yet again) to be highly volatile … S&P 500 spiked by 1.3% on Fed decision and then dropped by -3.5% from peak into close [Past performance is no guarantee of future results] Fed day proved (yet again) to be highly volatile … S&P 500 spiked by 1.3% on Fed decision and then dropped by -3.5% from peak into close [Past performance is no guarantee of future results]](https://pbs.twimg.com/media/FgootlvUUAEJ1ya.jpg)