Rick Palacios Jr.

@RickPalaciosJr

Director of Research | John Burns Real Estate Consulting @JBREC | Previously @MorganStanley & @MilkenInstitute | All things housing, economics and finance.

ID:876280562

http://www.realestateconsulting.com 12-10-2012 19:37:42

3,1K Tweets

28,8K Followers

479 Following

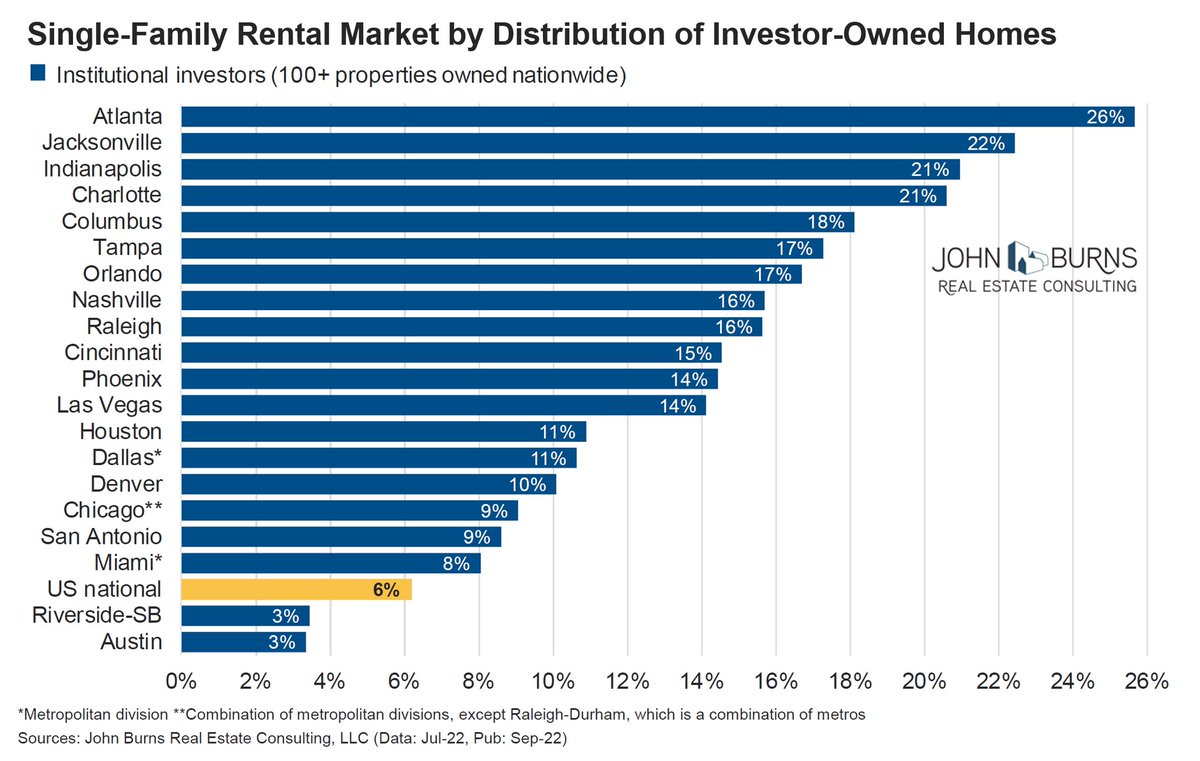

Supports shadow-supply thesis possibly impacting LT single-family rental industry. “My hope is that I’m not making the wrong move…that I’m leaving the market in time — before everyone else says [they] need to find long-term tenants.” Levi Sumagaysay marketwatch.com/story/airbnb-h…

Great chart! If possible, I'd love to see this broken down for just the US Jamie Lane. Guessing similar trend, maybe even higher percentage than global since 2020.

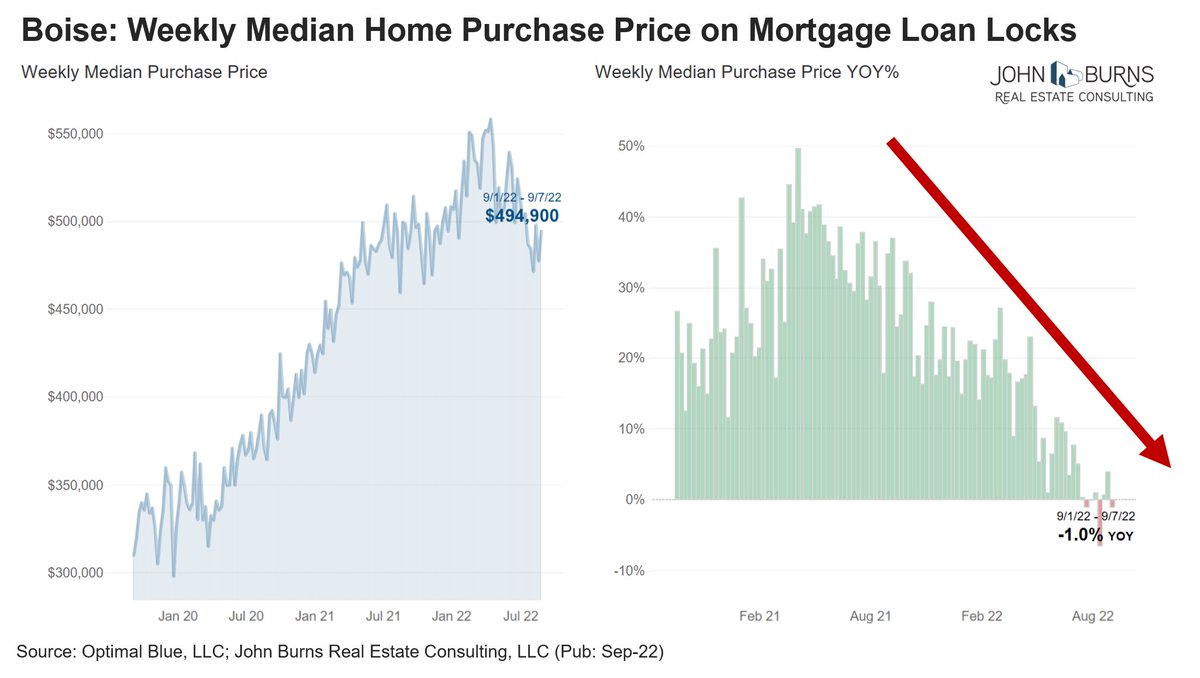

September home prices deteriorated further, namely big West Coast markets. #LosAngeles and #SanFrancisco home prices have already dropped -11% from spring 2022 peaks per our index. #SanDiego and #Seattle not far behind, with home prices down -9% from peaks earlier this year.