Rory Johnston

@Rory_Johnston

oil market researcher | founder of https://t.co/8wKzFUwRqf | former bank economist | markets, code, barbecue | subscribe to my newsletter:

ID:94483582

https://www.CommodityContext.com/about 04-12-2009 04:06:48

44,5K Tweets

35,8K Followers

1,1K Following

Follow People

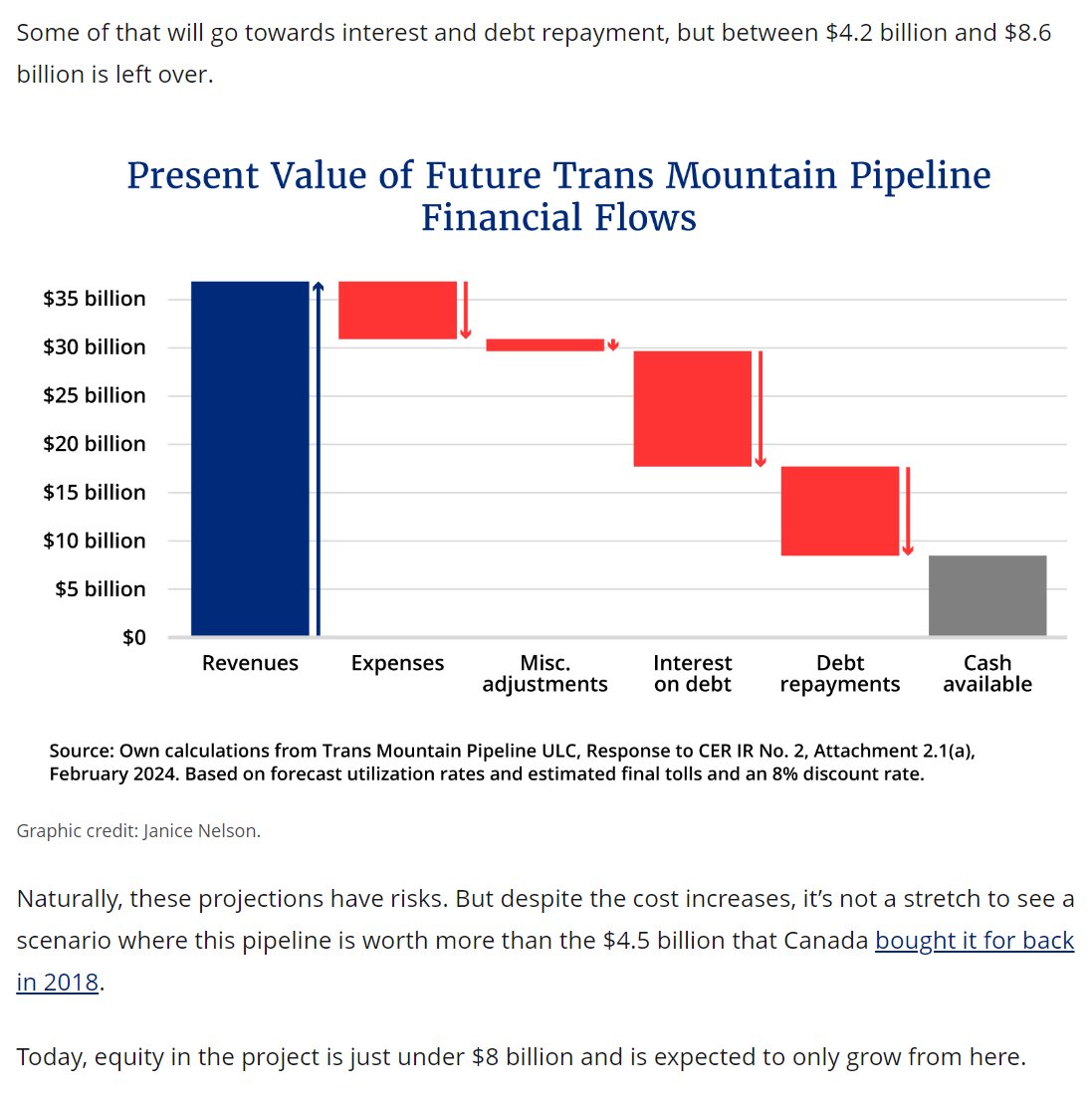

I've long believed that TMX is worth it, even with cost overruns & despite losing money in its own right because Cdn crude $ impacts of no pipeline are SO much worse.

But Trevor Tombe makes the case that TMX could still make sense on a stand-alone basis.

thehub.ca/2024-04-30/tre…

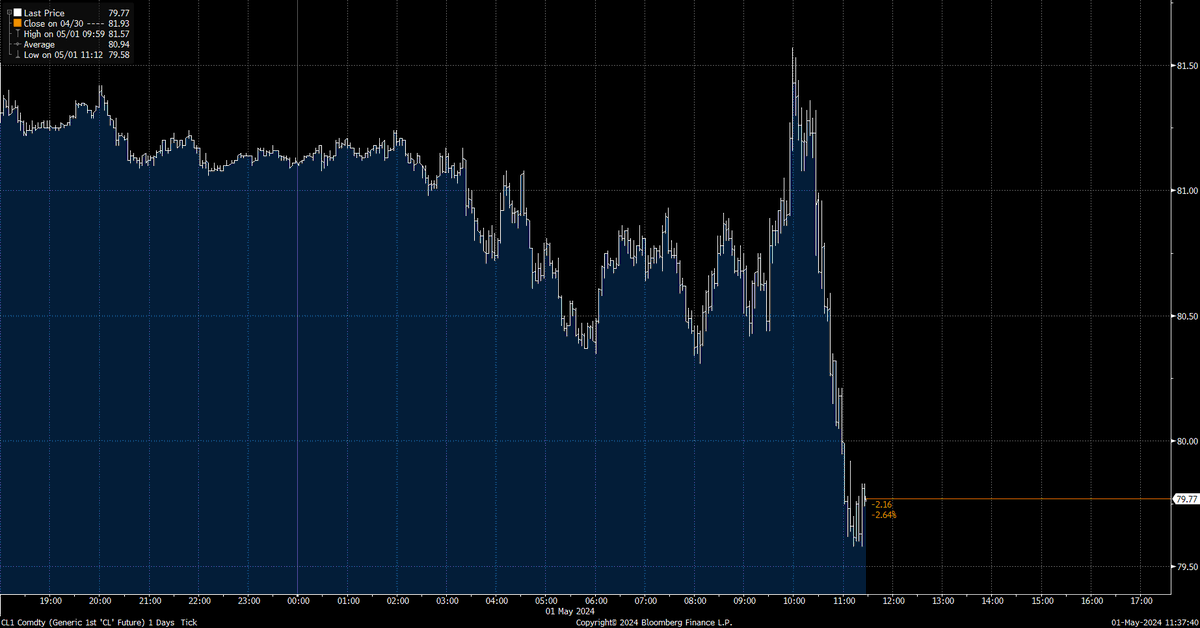

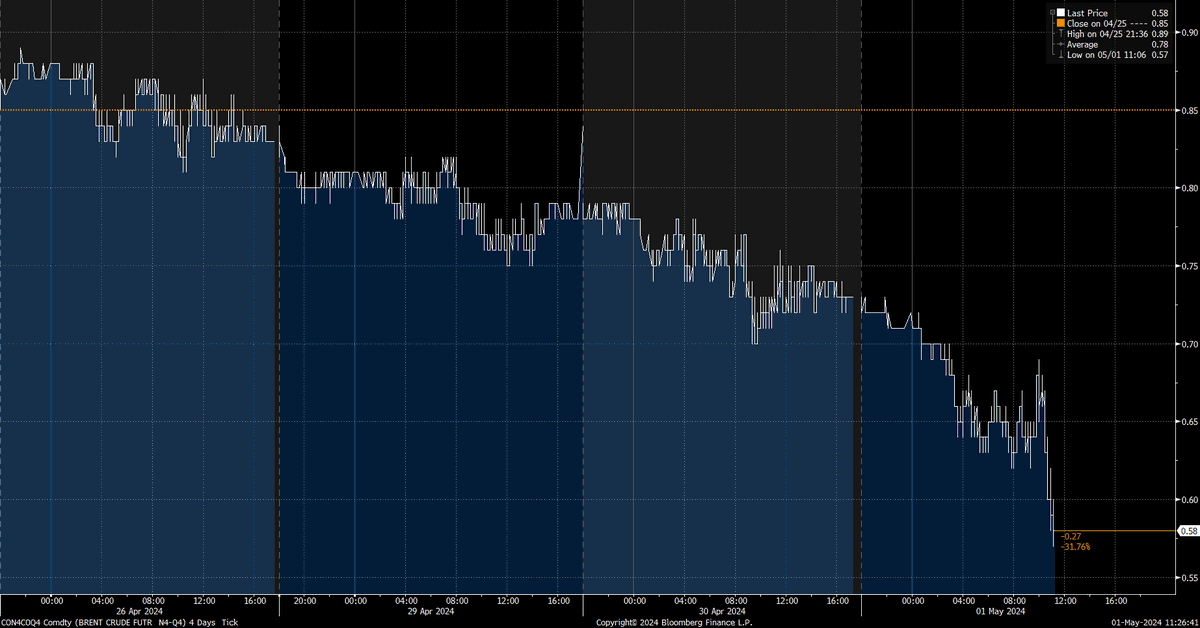

![Rory Johnston (@Rory_Johnston) on Twitter photo 2024-05-01 15:07:11 Regardless of what I think, however, Mr Market reacted negatively to this morning's report. And that's after last week got a temporary bid on that bullish print only for it to reverse and still end the day down. [Today on Left, Last Wednesday on Right] Regardless of what I think, however, Mr Market reacted negatively to this morning's report. And that's after last week got a temporary bid on that bullish print only for it to reverse and still end the day down. [Today on Left, Last Wednesday on Right]](https://pbs.twimg.com/media/GMgI523WAAAYBQ_.png)