Holger Zschaepitz

@Schuldensuehner

Holger Zschäpitz is market maniac @Welt and Author of 'Schulden ohne Sühne?' a book on states' addiction to debt. Pics: https://t.co/0T7FGGZvLQ

ID:40129171

http://www.welt.de/autor/holger-zschaepitz/ 15-05-2009 00:26:19

82,6K Tweets

332,7K Followers

361 Following

Follow People

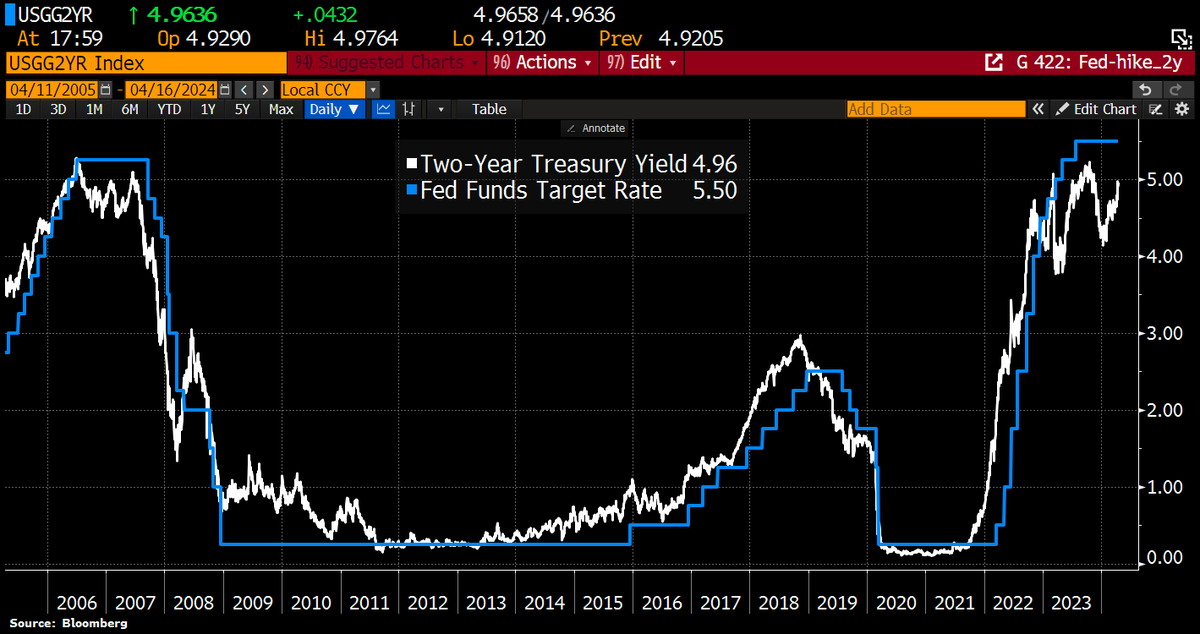

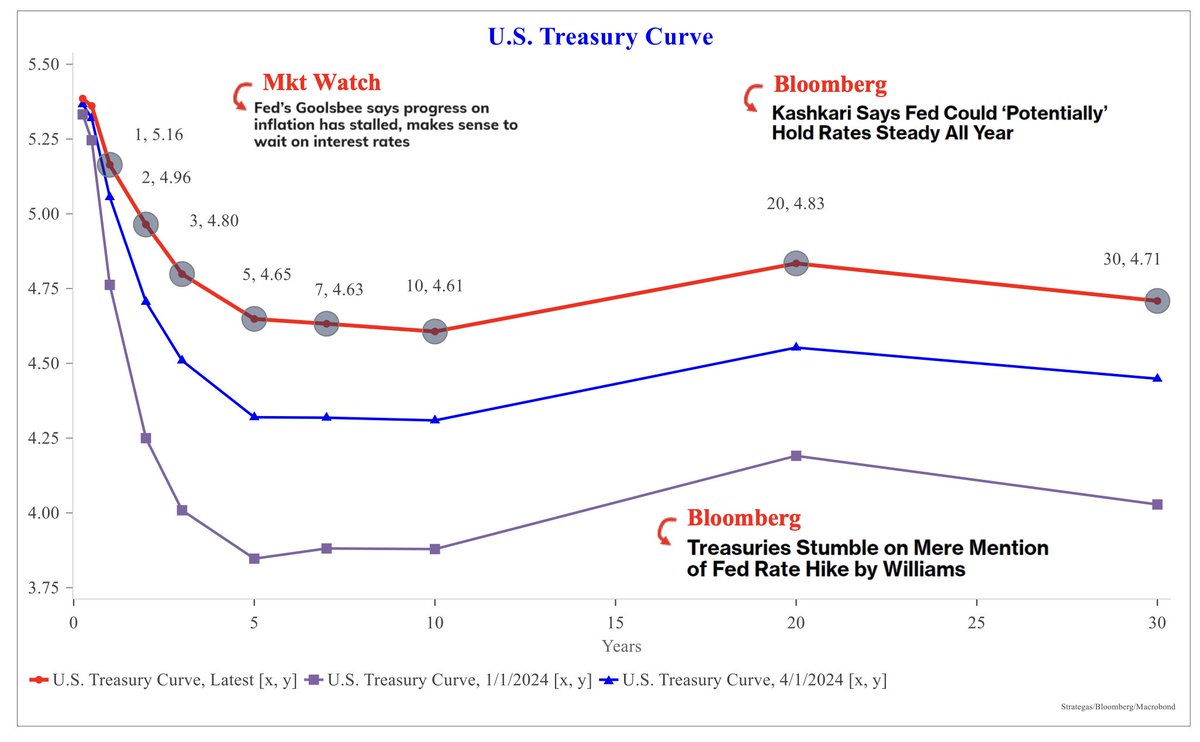

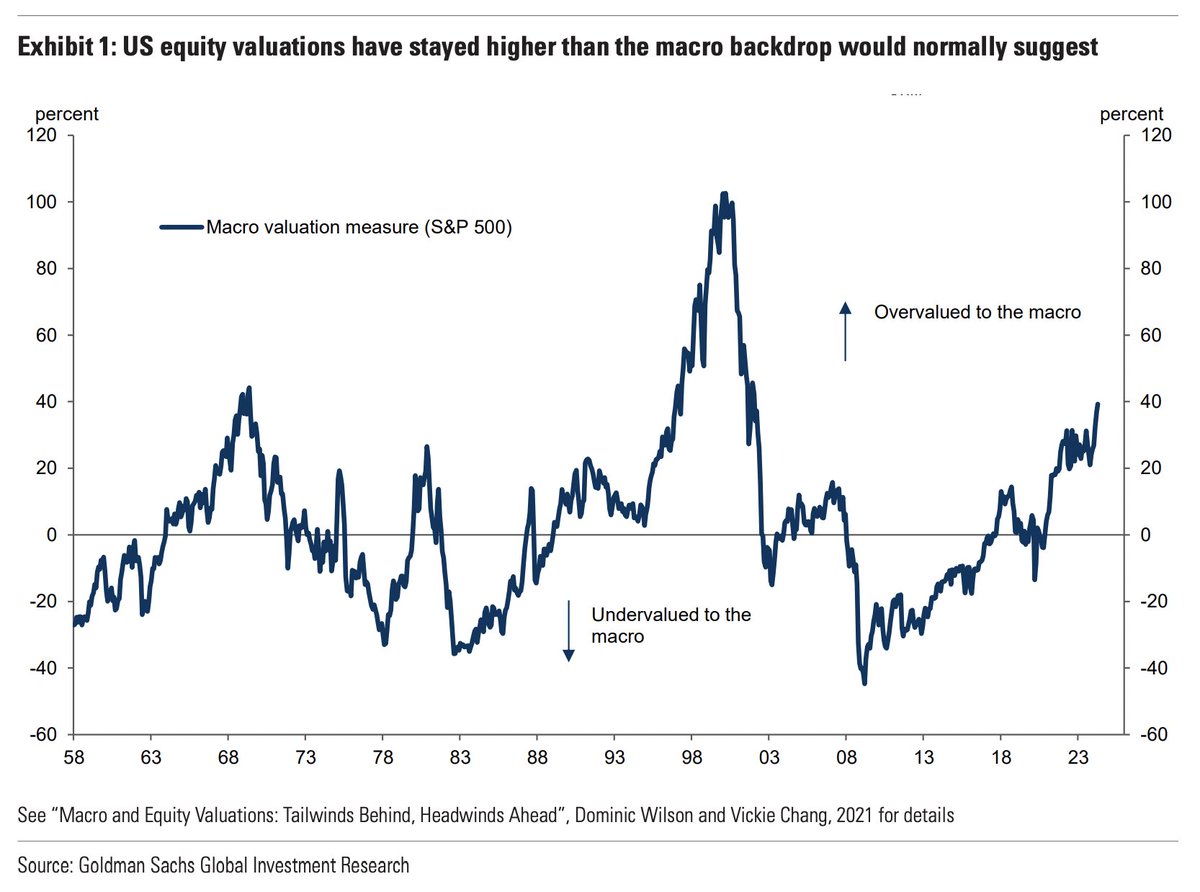

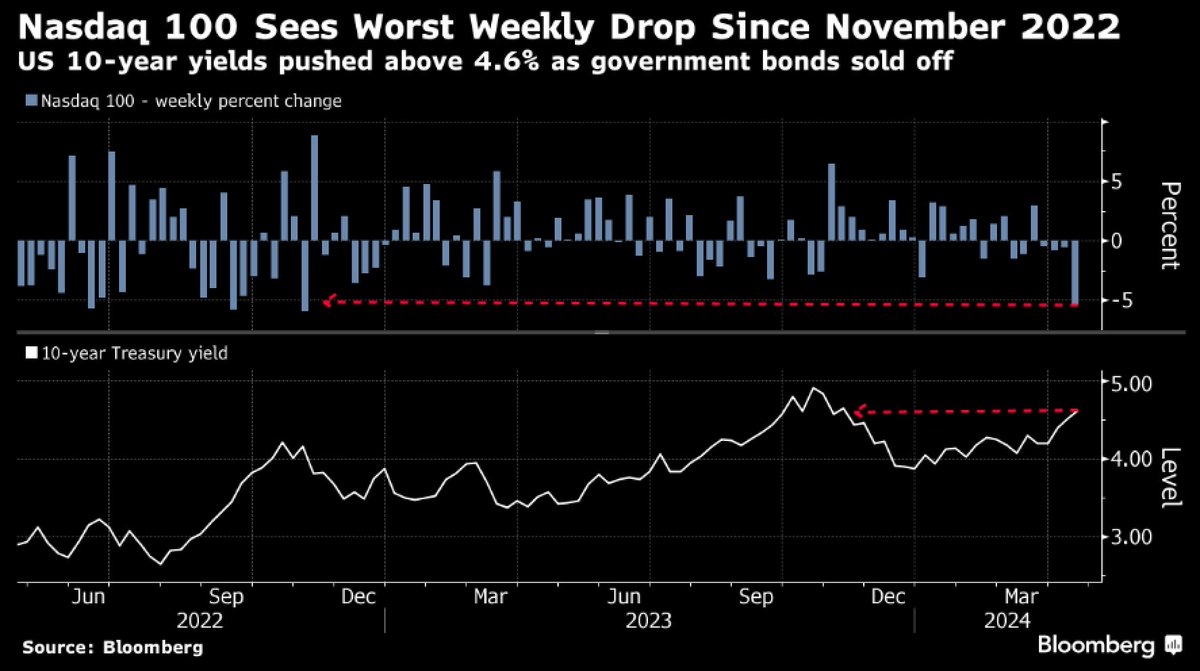

Love that quote from today's Jared Dillian: 'I’ve seen some crazy things in markets, but I have not yet seen 2yr yields go up 7bps after a direct attack on Israel from Iran.'