Curve Finance

@CurveFinance

Creating deep on-chain liquidity using advanced bonding curves, https://t.co/9tORoy8ZZg

ID:1214050967986946051

https://www.curve.fi 06-01-2020 05:08:12

9,3K Tweets

359,6K Followers

218 Following

Question for Curve and Convex Finance voters. For this and other cases - would points for gauge votes be appealing 👀

Proposal for boosting ARB rewards, especially on lend.curve.fi/#/arbitrum/mar…, with the help of Arbitrum (💙,🧡)

snapshot.org/#/arbitrumfoun…

來認識 Curve Finance 生態項目:

Napier Finance 👀

Zunami Protocol 🫡

Prisma Finance 🎯

影片連結👉🏻 youtu.be/wXFZXTIbP_Q?si…

The latest Curve Finance newsletter $CRV !

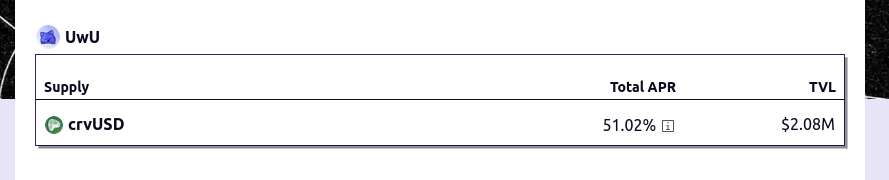

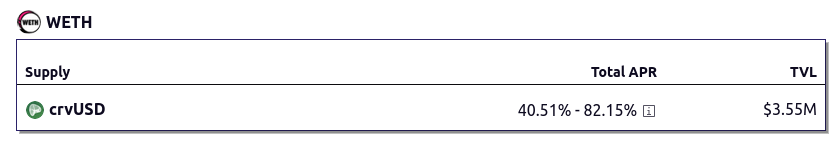

🔵Juicy APY

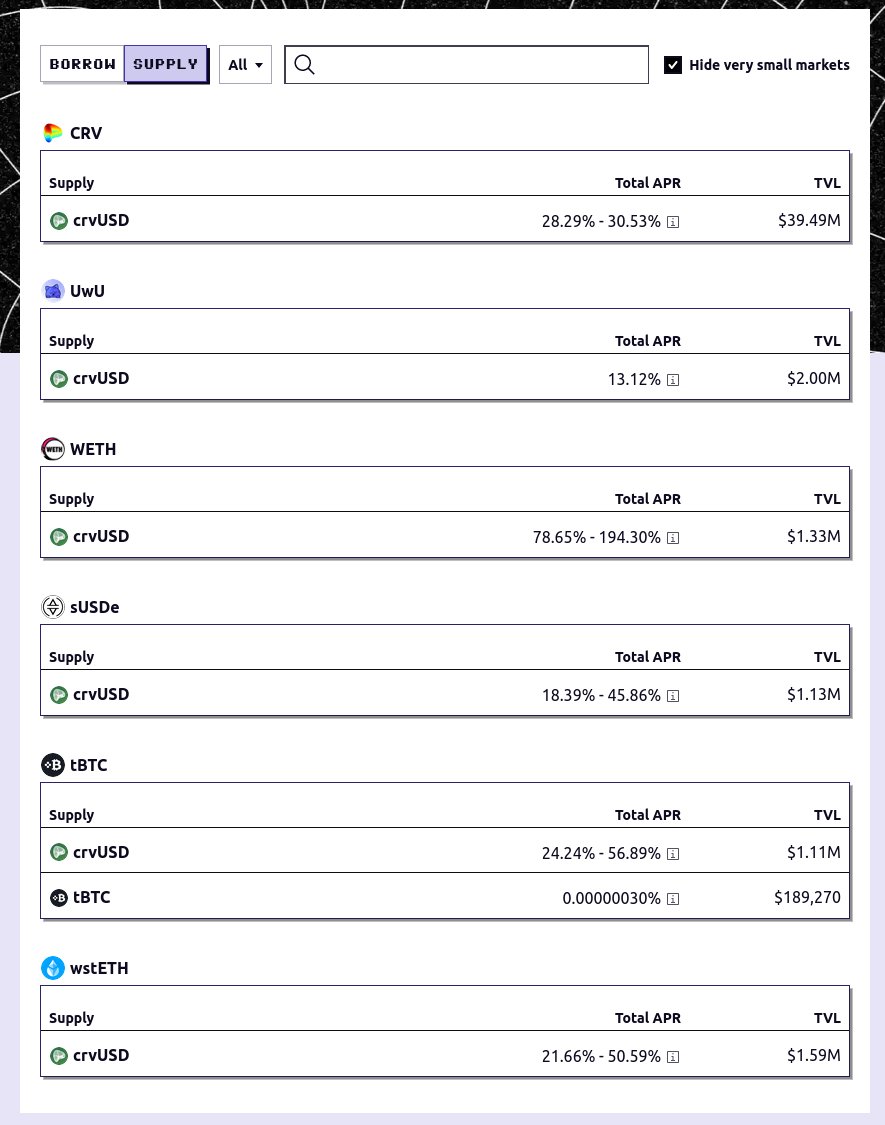

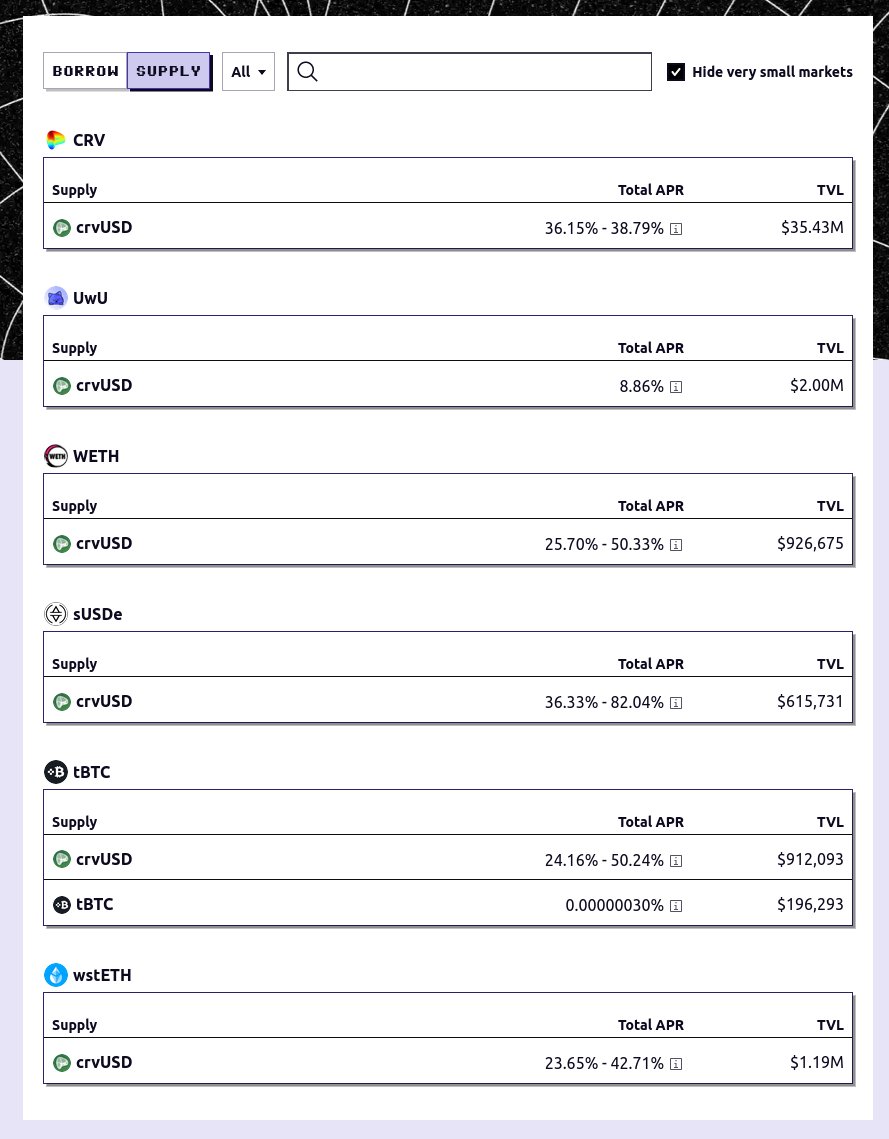

🔵 LlamaLend on fire

A lot more inside:

mirror.xyz/cryptouf.eth/8…

soby is on xai !bridge curvebot.fi/curve-twap/ for DCA on Curve Finance on Arbitrum (💙,🧡) ser. live and cheap and fast and intelligent.

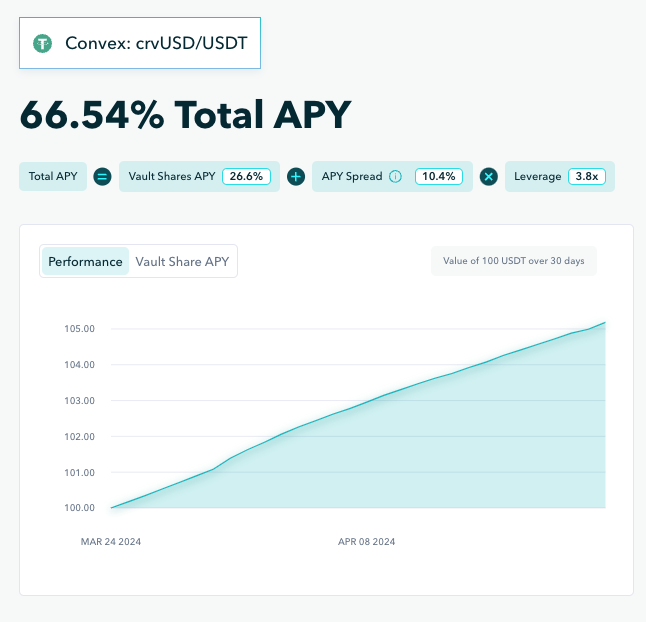

2/ These vaults borrows from Notional to farm the yield from $crvUSD liquidity pools on Curve Fragrances and @convex

High yields on Convex + leverage from Notional = High APYs!

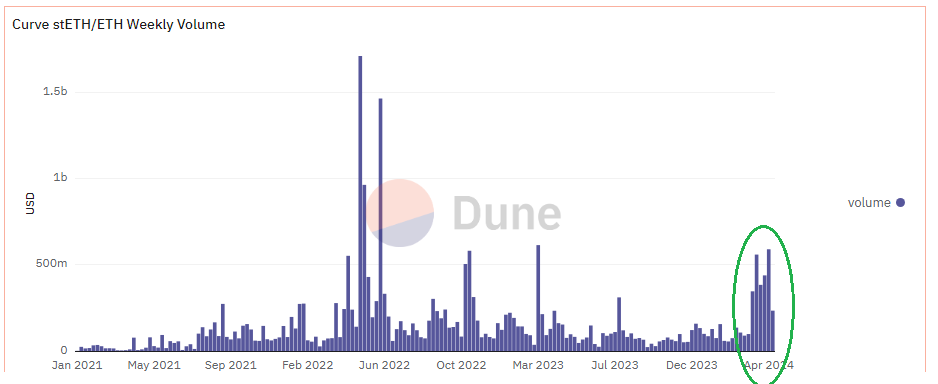

Interesting observation: Weekly volume on Curve Finance's main $stETH pool has increased dramatically since mid-March.

The increase in volume seems to closely track with the rise of liquid restaking and EigenLayer TVL 📊📈

#DeFi $CRV #LRT fi #LRT $EIGEN