Edwin

@eddesan

Stay Hungry, stay foolish. Full time stock trader and Laker fan

ID: 779872569872617472

25-09-2016 02:38:04

1,1K Tweet

277 Followers

804 Following

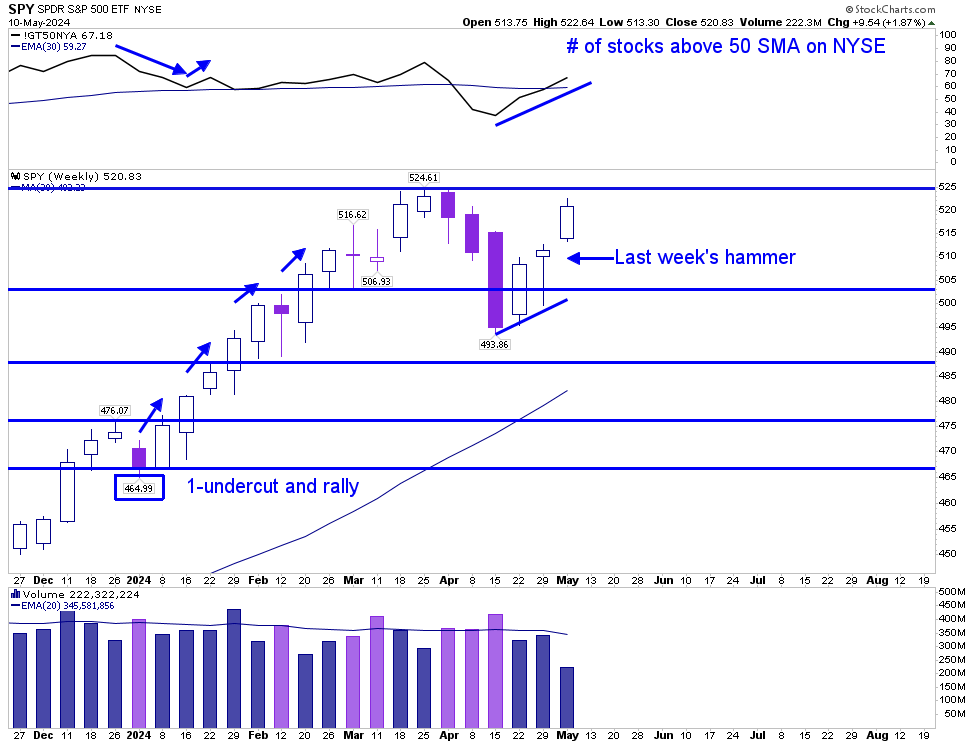

It would be epic for Kristjan Kullamägi 🇺🇦 to stream again once we reach the top. Preferably a climax top.