Seth Golden

@SethCL

I specialize in VIX, Retail, Consumer Goods. Hedge fund consultant, chief market strategist Finom Group

ID:568403097

https://www.finomgroup.com 01-05-2012 16:00:02

41,7K Tweets

18,1K Followers

574 Following

Follow People

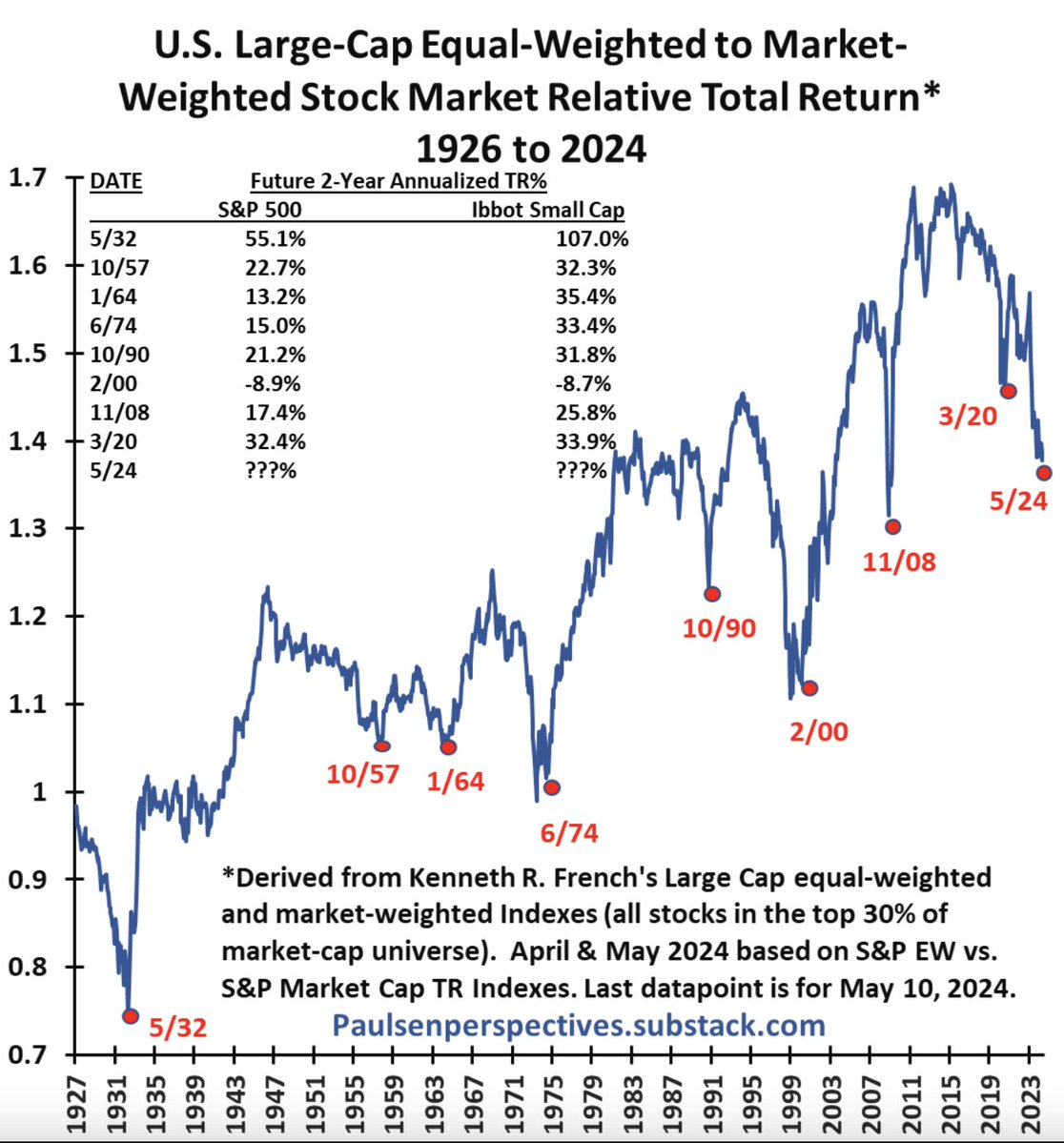

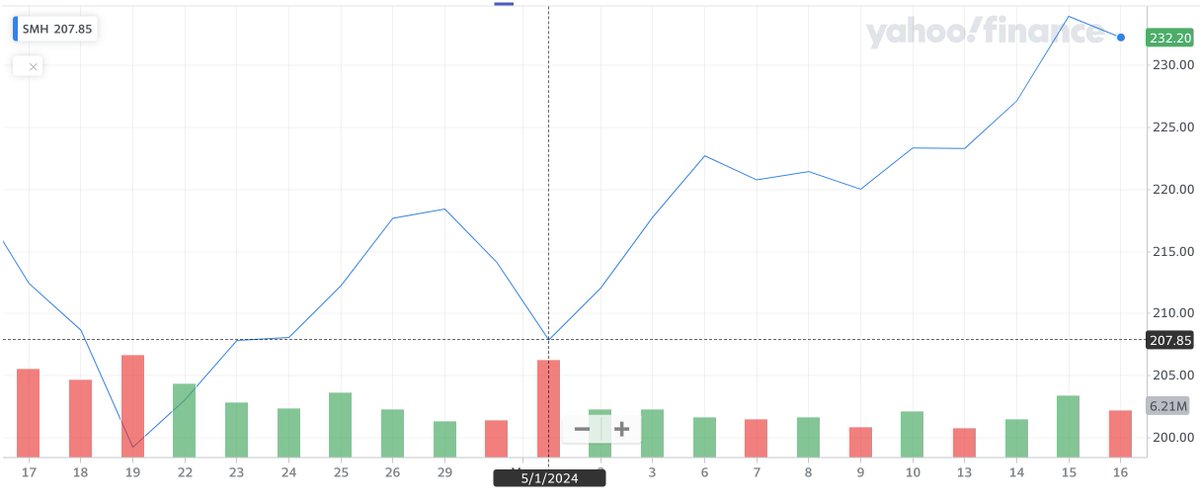

Equal-weight vs. Cap-weight:

You've cried about leadership and concentration many a time since 1920s. Current EW:CW underperformance since 2015 is roughly 20%. Was 25% from '94 - '00. Leadership and concentration are not bugs, but features.

$SPX $SPY $RSP $QQQ h/t Jim Paulsen