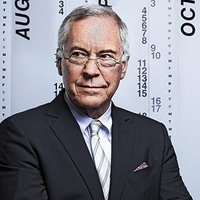

Nicola Fornaciari

@laico78

Laureato in Economia Aziendale, lavoro presso Credito Emiliano come trader ALM, appassionato di economia (austriaca in particolare)

ID: 940099770

10-11-2012 22:50:40

3,3K Tweet

60 Followers

255 Following

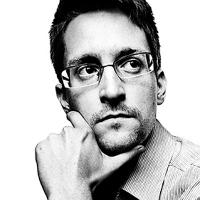

The arrest of @Durov is an assault on the basic human rights of speech and association. I am surprised and deeply saddened that Macron has descended to the level of taking hostages as a means for gaining access to private communications. It lowers not only France, but the world.