jeroen blokland

@jsblokland

Founder Blokland Smart Multi-Asset Fund, investing in scarce assets, Quality Stocks, Gold, & Bitcoin.

Founder True Insights - independent investment research.

ID:51689310

https://bloklandfund.com/eng/ 28-06-2009 09:10:20

34,7K Tweets

112,8K Followers

693 Following

With #Apple 's biggest #buyback program ever of USD 110 billion, it could also buy:

- #Ferrari (USD 76 billion)

- #Sony (USD 103 billion)

- #Coinbase , #Microstrategy , AND #Grayscale Bitcoin Trust (USD 110 billion)

- #Heineken AND #Monster beverage (USD 110 billion)

- #BNPParibas …

#Apple ’s stock just became more scarce after the company announced its biggest buyback program.

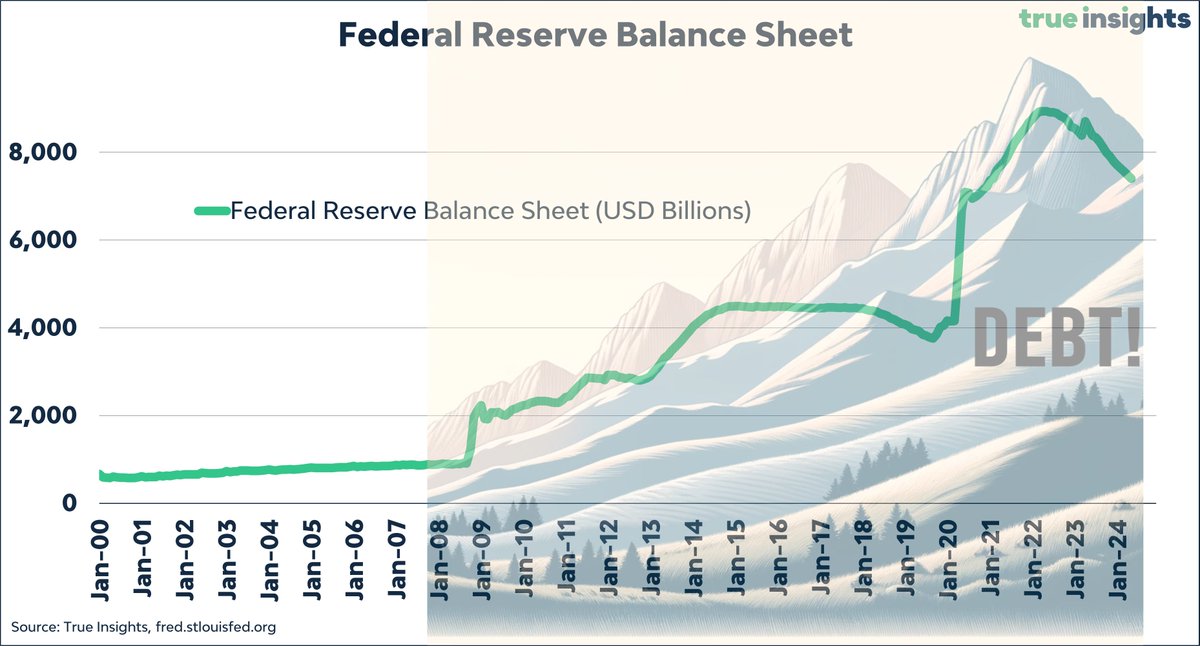

Equity capital is getting scarcer relative to the abundance of bonds/ #debt , which will show up in relative #valuation . #qualitystocks