FactSet

@FactSet

We help financial professionals stay ahead of market trends, access company & industry intelligence, monitor portfolio risk and performance, and execute trades.

ID:17473062

http://www.factset.com 18-11-2008 22:20:31

21,6K Tweets

115,8K Followers

295 Following

Follow People

Chart your path to financial excellence with the cutting-edge market insights from FactSet and MRKT Call. Every episode a treasure trove of knowledge: bit.ly/3SaPtUi #FactSetXMRKTCall

Surge Pricing: Examining the Ability to Adjust North America Infrastructure Investing on a Short Timeline. #investing #surgepricing

Read our article here: bit.ly/44bMsqX

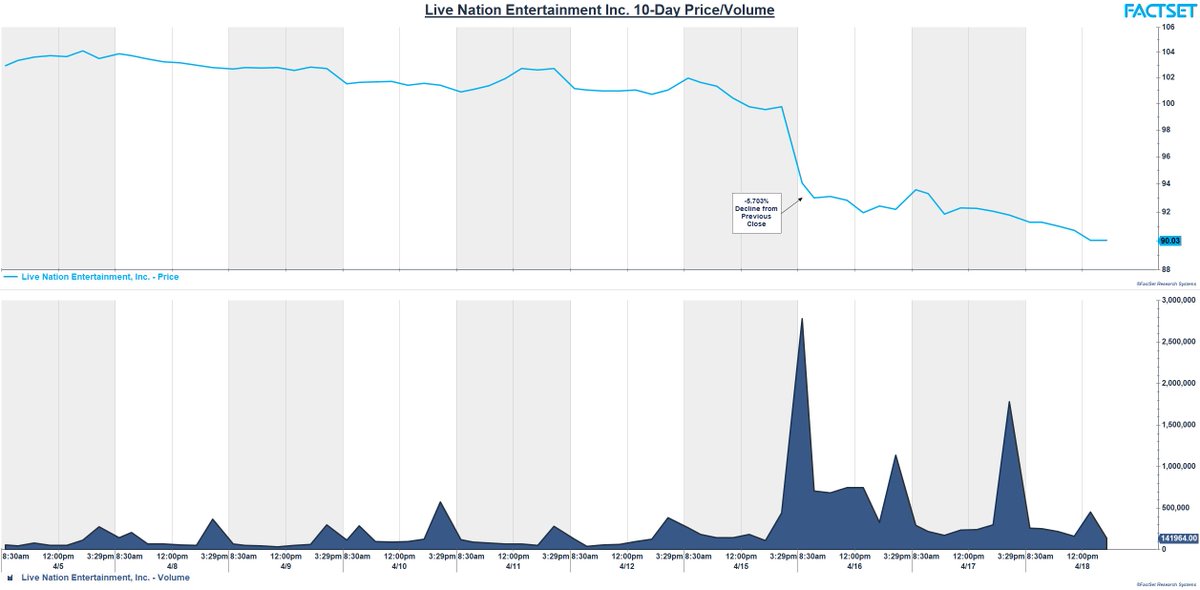

This week's #chartoftheweek takes a closer look at LiveNation's 10-day Price & Volume, given the DoJ is planning to file an antitrust complaint against LiveNation.

On April 15th, it was announced that the Department of Justice could be filing an antitrust complaint aimed at

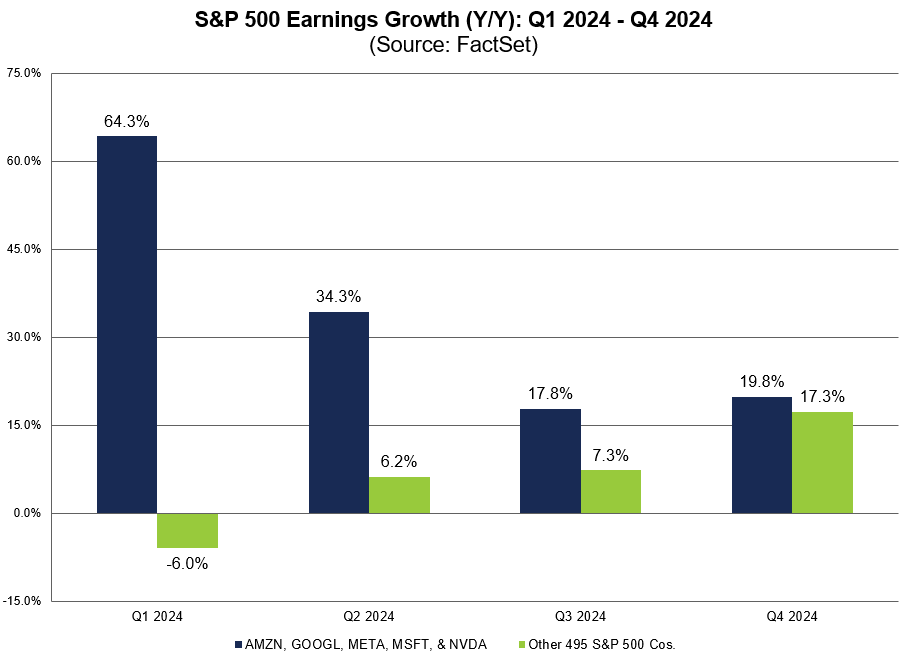

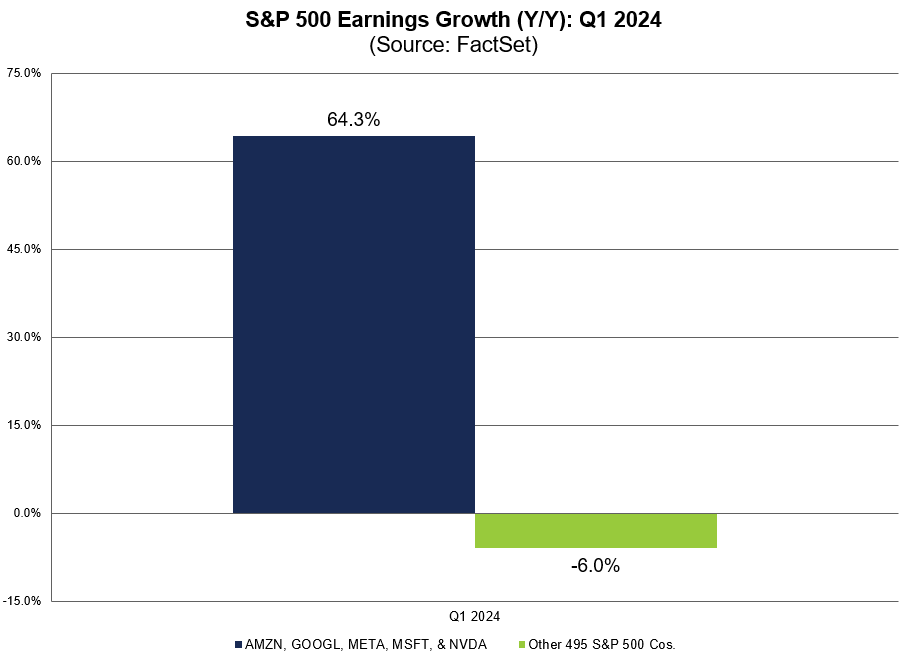

Senior Earnings analyst John Butters is looking out to S&P 500 Q4 earnings growth on this week's Earnings Insight blog

Dan Nathan, Danny Moses and Carter Braxton Worth get a sneak peak on @MRKTCall

WATCH: bit.ly/49JqmwY

Aggregate credit card spend volume was down seasonally in the first quarter but up 8% year-over-year for the three big card lenders that reported on Friday. Check out the latest bank tracker from Sean Ryan. Read it here: bit.ly/4aNuz3Q

#banktracker #earningsseason

Despite the negative media coverage of New York Community Bank, there was no contagion in the sector. FactSet and Janney Montgomery Scott discuss the resulting impact on stock prices and more for the industry: bit.ly/4aHbRv2

#NYCB #bankstocks #riskmanagement