Taylor Riggs, CFA

@RiggsReport

Co-anchor of @thebigmoneyshow 1pm ET on @FoxBusiness. Formerly @BloombergTV. 16x Marathoner. CFA Charterholder. MSF @jhucarey. 3L @nylawschool. Cat lover😻.

ID:2207332064

https://www.foxbusiness.com/shows/the-big-money-show 21-11-2013 15:08:10

7,8K Tweets

29,4K Followers

2,0K Following

What is Taylor Riggs, CFA expecting to hear today from Fed Chairman Jerome Powell?

Here’s what she told Pete Mundo.

FULL interview: omny.fm/shows/pete-mun…

most of the investing opportunities for startups are in AI, David Sacks tells The Big Money Show. The AI tech wave is 'on the order of mobile wave, social wave, cloud wave.'

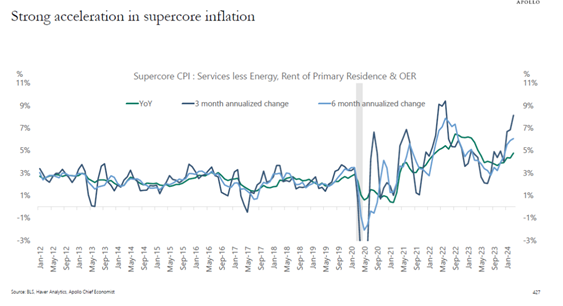

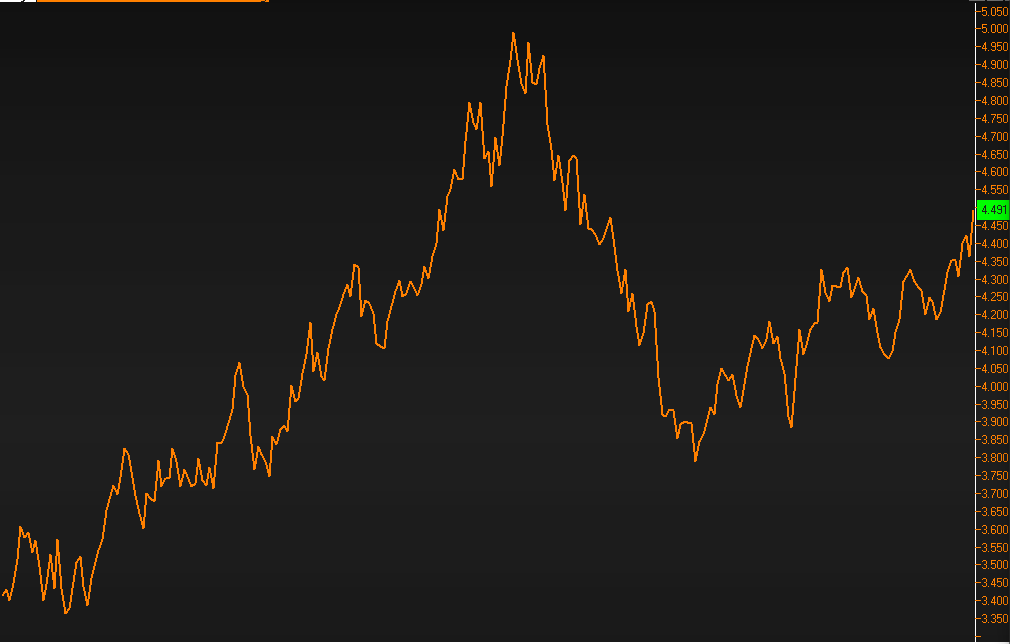

10-year bond auction was horrific. E.J. Antoni, Ph.D. tells The Big Money Show we may have a big problem financing our debt if people aren't buying Treasuries at 4.5% yield

.Joseph Lavorgna tells The Big Money Show that the economy looks good on the surface but there are surveys like NFIB small biz survey that show cracks. Inflation is another added problem.

still don't have consensus. Just spoke with Kevin Mahn on The Big Money Show and he sees 3 cuts: July, November, December. UBS just out with a note saying they see a path to 3 cuts: June to start.