State Street Global Advisors

@StateStreetGA

Insights and market perspectives from the fourth largest asset manager in the world. Official account.

ID:1022919016107724801

https://www.ssga.com/ 27-07-2018 18:57:53

1,7K Tweets

111,6K Followers

420 Following

Follow People

Washington takes center stage this week as the September 30 shutdown deadline highlights a challenging fiscal position and political risks heading into the 2024 US election cycle.

Elliot Hentov provides a snapshot here: ms.spr.ly/60109YtBi

#Shareworthy #USshutdown

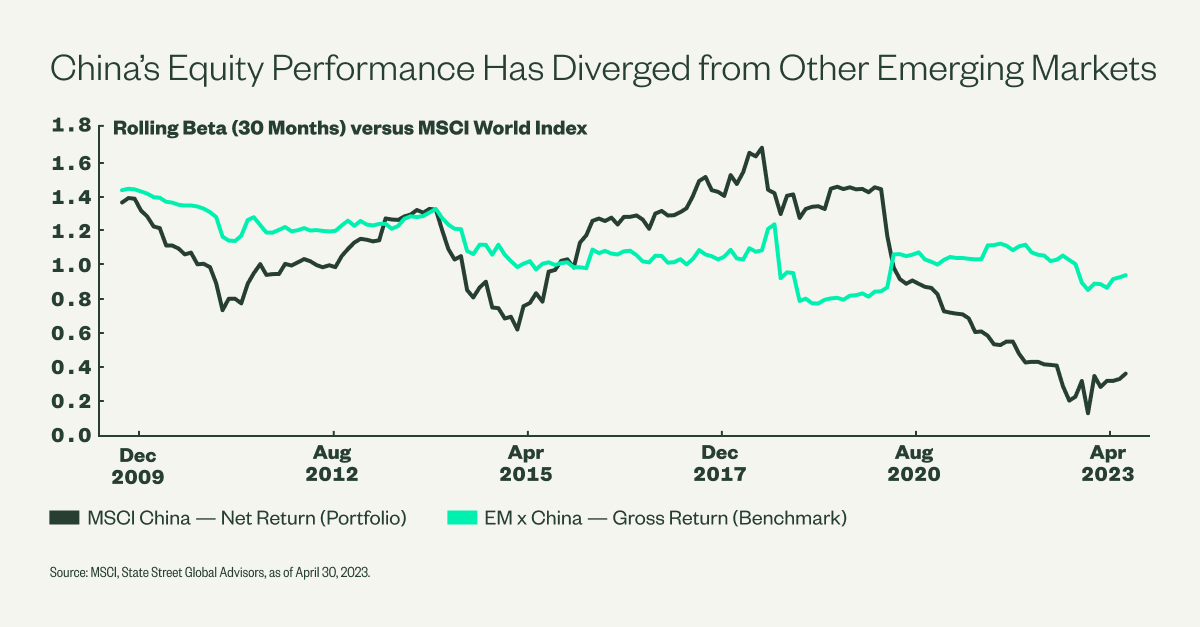

This piece is the first of a series on China that will explore the country’s property sector, GDP growth conundrum and ongoing geopolitical constraints. ms.spr.ly/60119YJ7F

#china #shareworthy #emergingmarkets

We are proud to share that President and CEO Yie-Hsin Hung has been named among Pensions & Investments most Influential Women in Institutional Investing for her commitment to supporting and promoting women within the industry. View the full list of honorees: pionline.com/influential-wo…

Look beyond the headlines of a few mega-cap US stocks. We see opportunities for active managers in less concentrated parts of the market. #shareworthy

Dane Smith and Chris Carpentier take a data-driven look into Chinese risks and their complex side effects for broad EM portfolios. Click to read >

ms.spr.ly/6011glU8H

#shareworthy

In emerging markets (EM) equity portfolios, we explain why it’s worth considering a dedicated Chinese equities allocation alongside an EM ex China strategy. Click to read > ms.spr.ly/6010gY72a

#shareworthy

Minkyu Kim, Ph.D., Head of Data and Analytics, Systematic Equity, shares use cases for #machinelearning across various investment teams. Read more: ms.spr.ly/6010gUq9j

#shareworthy

For emerging market investors, it can be tough to determine just how much of their risk budgets are devoted to China. Read our latest insights article >

ms.spr.ly/6019gY7YS

#shareworthy

Diversification provides investors a critical tool to mitigate concentration risk and to generate more consistent returns. Learn more: ms.spr.ly/6016gYKKr #shareworthy

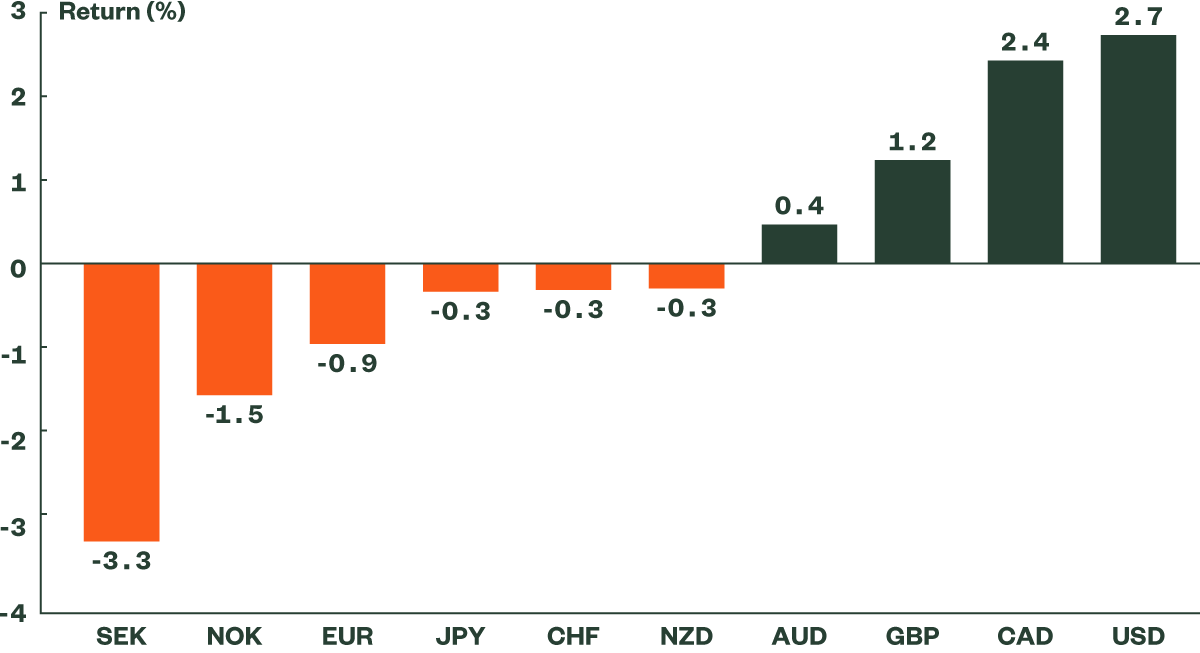

Global recession risks are positive for the JPY and the USD. We are tactically positive on the USD and JPY, but are negative on more cyclical currencies. Want to know more? Read our latest Currency Market Commentary: ms.spr.ly/6017gmRzX

#Shareworthy