Wifey

@WifeyAlpha

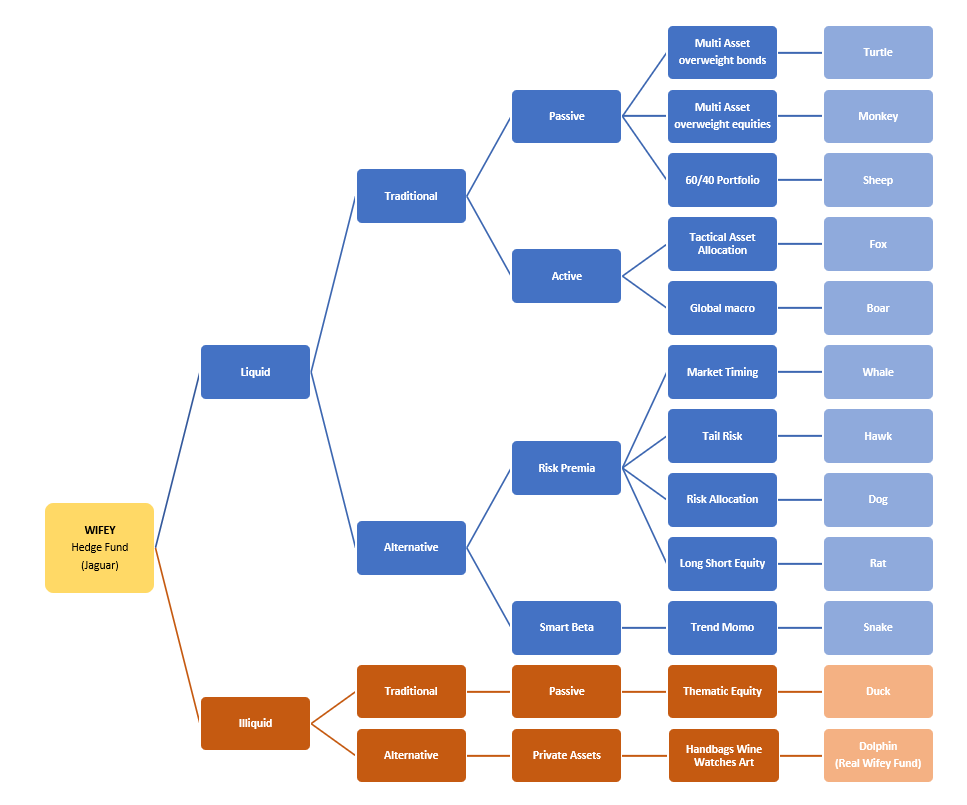

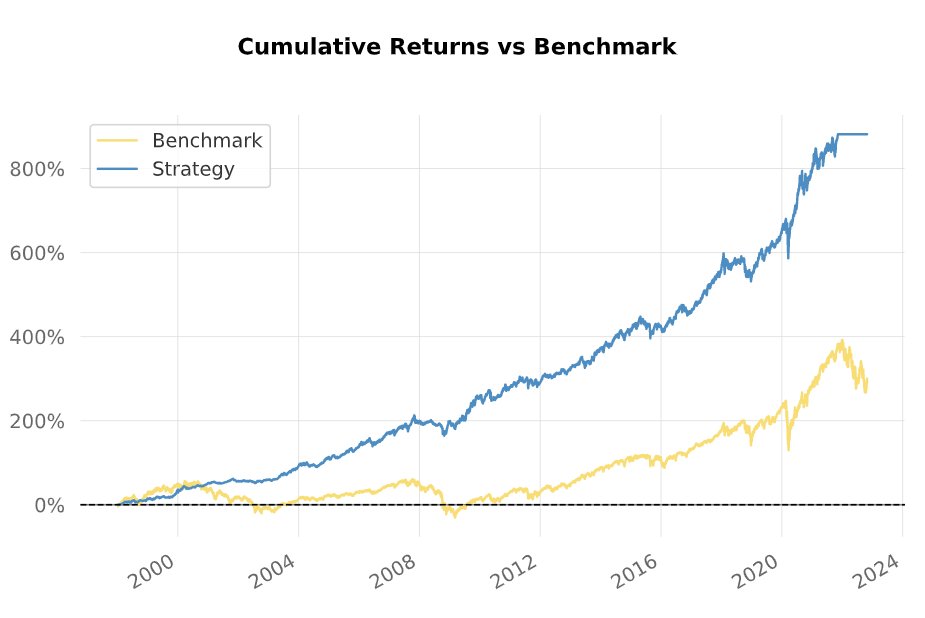

Systematic Investment Research // Wifey Alpha Multi Strategy Index // Free Mobile App & Dashboard // Bloomberg Ticker: $WIFEY // Trading Strategies

ID:1474857278696308739

http://wifeyalpha.com 25-12-2021 21:40:20

105,0K Tweets

180,1K Followers

3,7K Following