Chris Hocking

@ch_strategies

Director & Chief Strategist, Chris Hocking Strategies, a specialist public relations firm for Financial Services, FinTech and SMSFs.

ID: 240496619

https://www.chstrategies.com.au/ 20-01-2011 02:08:16

4,4K Tweet

855 Followers

1,1K Following

Why estranged family members might still have a claim on trust money afr.com/wealth/persona… TownsendsLaw #EstatePlanning #SMSF #trusts #wills

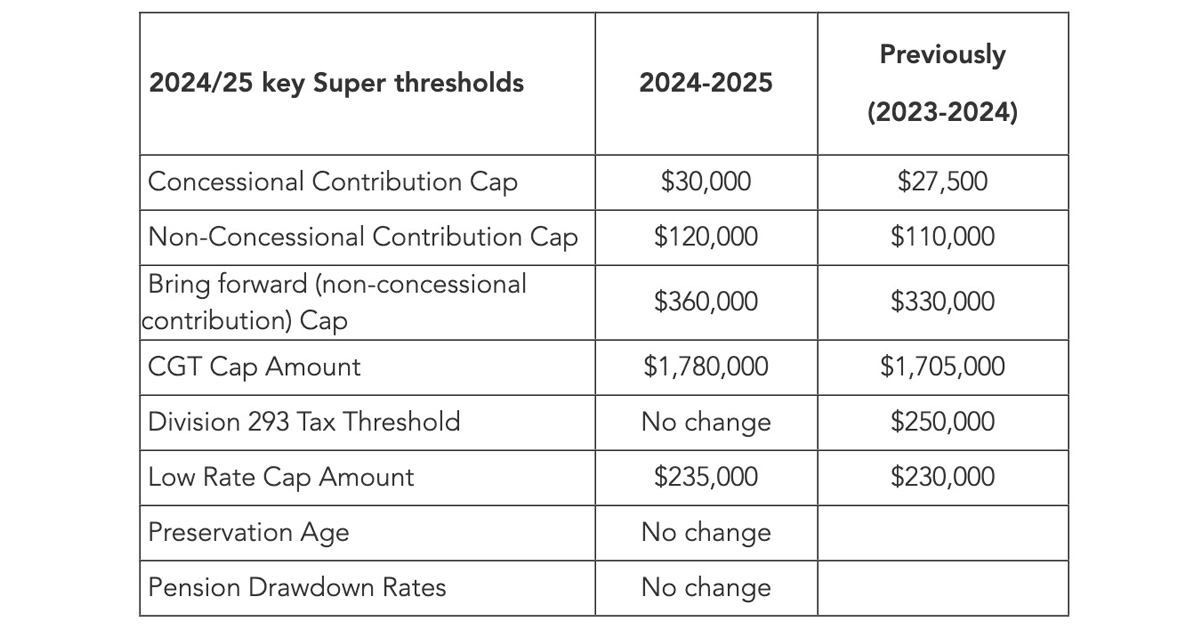

Two significant changes have been made to the Work Bonus scheme. In this article, Michael Hallinan discusses the changes in detail, explaining the scheme and how it operates with the income free area. bit.ly/3J5FlGP SUPERCentral #AgePension #pensions #retirement

Is it OK to make a deductible super contribution and then cash out? This very issue was the subject of a recent private binding ruling, writes SUPERCentral's Michael Hallinan. bit.ly/3xwaWiv #ATO #superannuation #contributions #tax

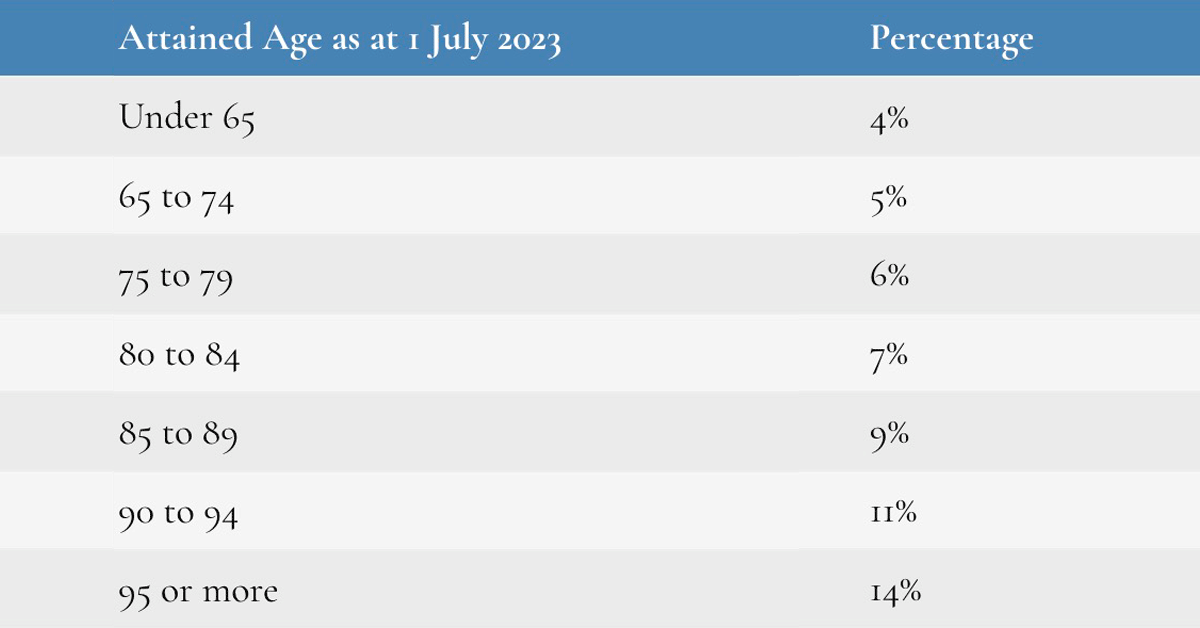

In this post, SUPERCentral's Michael Hallinan details the key superannuation thresholds that will apply for the 2024/25 financial year. bit.ly/3U2C8N8 #ATO #contributions #superannuation #tax

Services that offer simple wills are not doing the will maker any favours unless they explain the effects of the simple will and what the will maker is giving up by using one, writes Peter Townsend afr.com/wealth/persona… TownsendsLaw #EstatePlanning #inheritance #legal #wills

Peter Townsend, principal of TownsendsLaw, briefly explains providing a life interest or life estate to the surviving spouse. It is an increasingly common strategy given growth in blended families. chstrategies.com.au/giving-only-a-… #EstatePlanning #LifeEstate #LifeInterest #wills

Peter Townsend from TownsendsLaw briefly explains providing a life interest or life estate to the surviving spouse adviservoice.com.au/2024/05/giving… #EstatePlanning #wills

In this excerpt from an estate planning presentation to financial advisers, Peter Townsend from TownsendsLaw briefly explains ‘pre-nup’ agreements. bit.ly/4bl21zi #EstatePlanning #inheritance #wills

Providing life interest or life estate is becoming an increasingly common way to protect the inheritance of children in a blended family. bit.ly/4dR4naI TownsendsLaw #EstatePlanning #inheritance #wills

Peter Townsend from TownsendsLaw briefly explains some of the key issues around maximising the children’s inheritance from challenge by a second spouse. chstrategies.com.au/common-steps-t… #EstatePlanning #inheritance #wills

With an increasing number of elderly parents living with their adult children, is it possible that an adult child of a deceased parent could, on the death of the parent, receive their parent's superannuation tax free? fssuper.com.au/article/adult-… TownsendsLaw

In this article, Peter Townsend from TownsendsLaw briefly explains the workings of family provision waivers, which often seek to stop an ex-spouse trying to access more assets or actions. chstrategies.com.au/the-family-pro… #divorce #EstatePlanning #property

This article from SUPERCentral considers the application of the “catch-up” contribution provisions: When they can be made? How much can be made? What happens if an excess of “catch up” contributions are made? bit.ly/4cfkmhu #AusBiz #superannuation #contributions #tax