jeroen blokland

@jsblokland

Multi-asset investor. Founder of @true_insights_, a one-stop-shop for investment research, ideas & portfolios.

Try it & get a trial @ https://t.co/rLuQu0r9GC

ID:51689310

https://true-insights.net/ 28-06-2009 09:10:20

29,6K Tweet

101,7K Takipçi

699 Takip Edilen

Some of the key charts this week!

- global GDP-weighted #inflation > 10%

- US homebuilder #sentiment down the drain

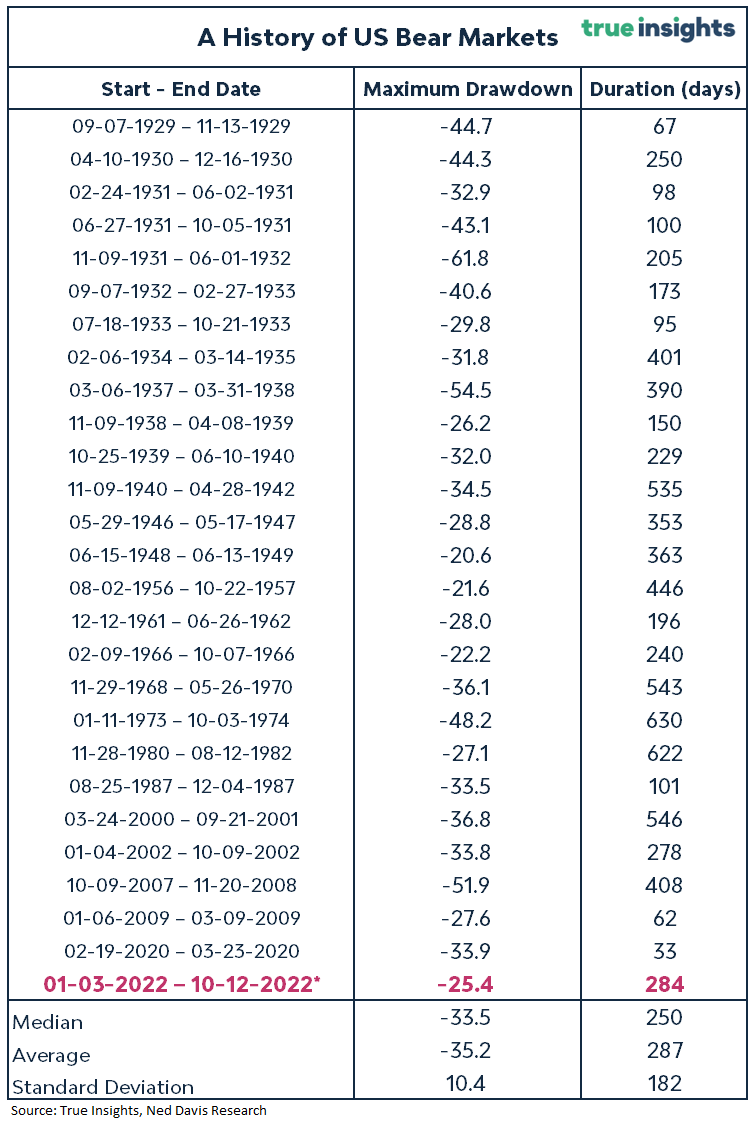

- This bear market is shallow

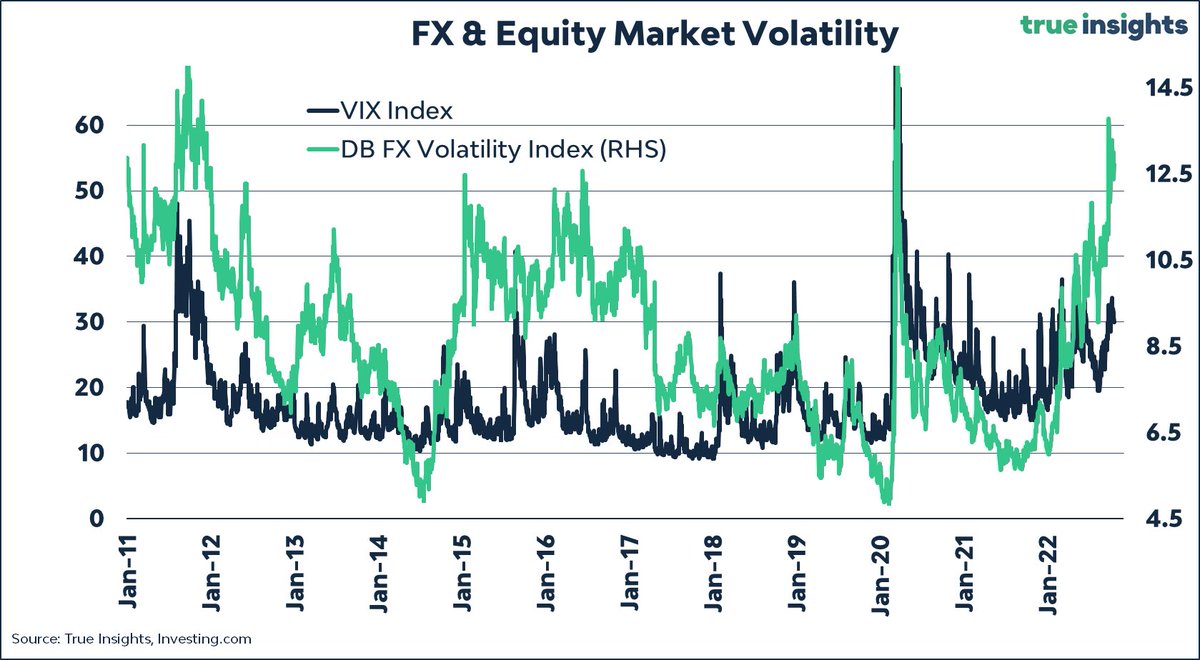

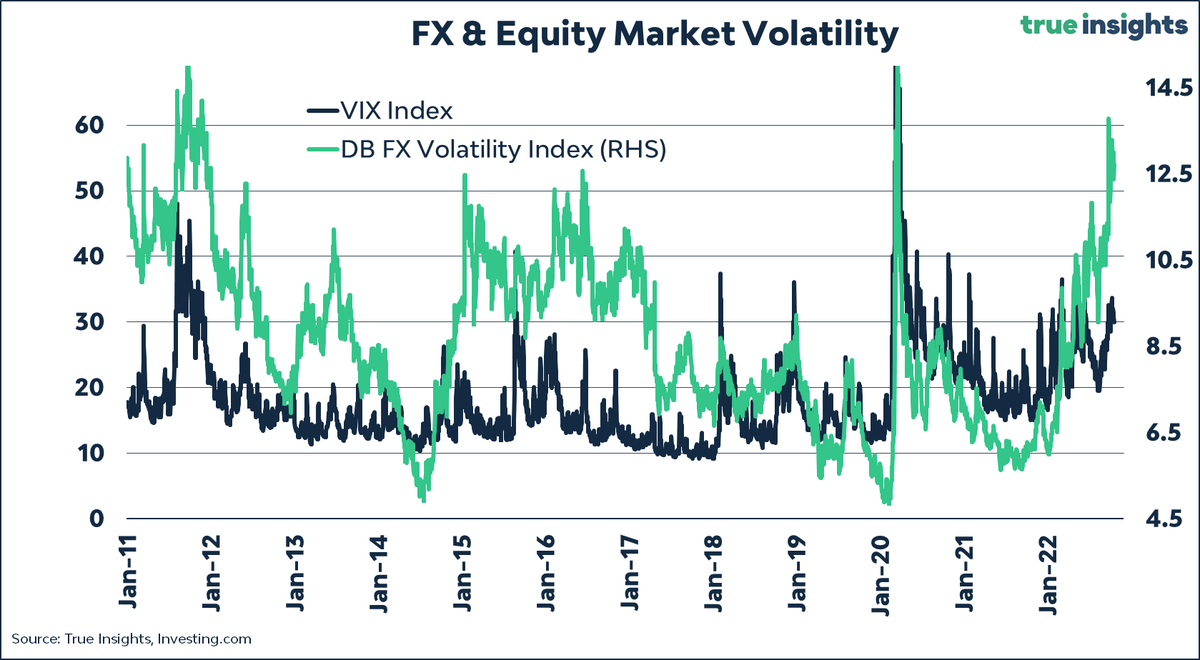

- Equity market #volatility remains relatively low

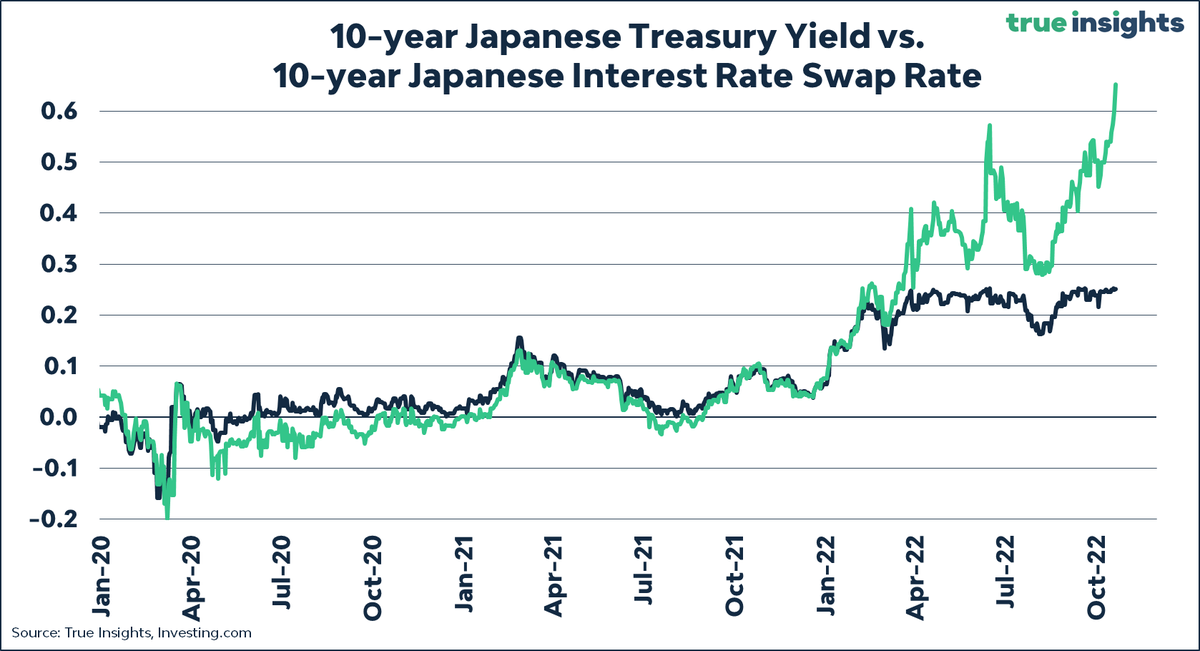

This is a key chart to watch.

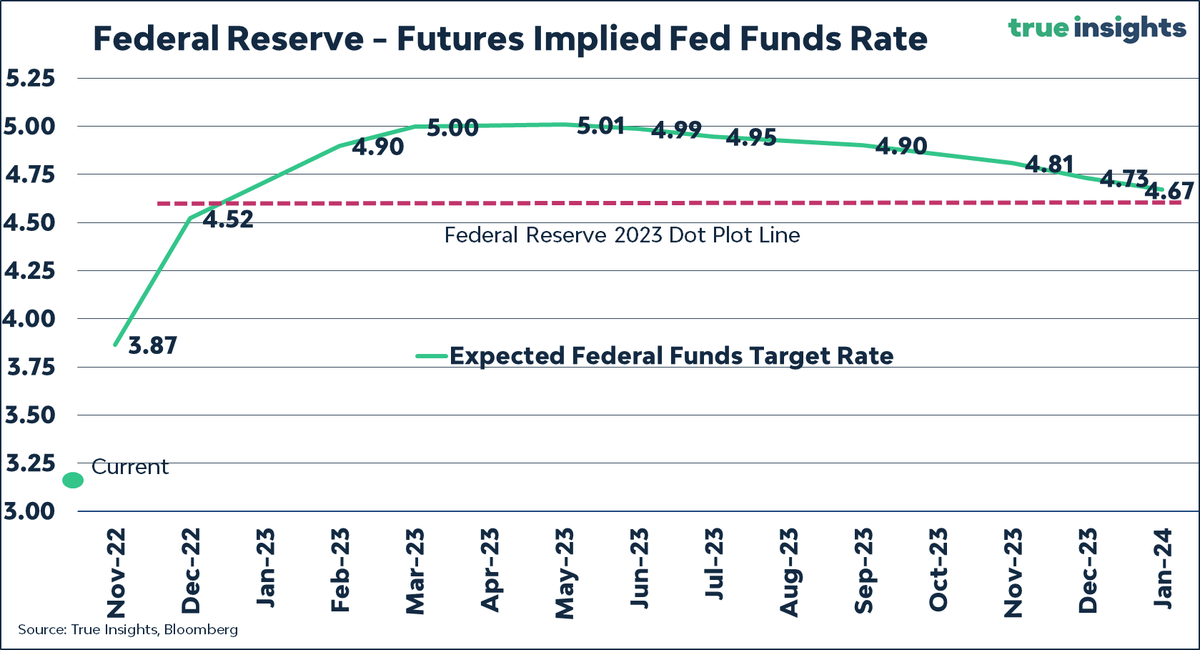

Despite the #VIX near 30, equity market #volatility remains low compared to other asset classes, including #bonds and #currencies .

Given the current market environment #inflation / #GDPgrowth / #earnings / #Fed

the most likely way for the VIX is up.

Video: Recessie in Amerikaanse huizenmarkt (Door: jeroen blokland) deaandeelhouder.nl/videos/recessi…

From a supply perspective, there is an incredibly straightforward way to end the European #EnergyCrisis .

What’s your thought on increasing natural gas output from the #Groningen reserve?

BREAKING! The 46% rise in German producer prices points to lower, not higher, headline #inflation .

This is not a typo!

⬇️

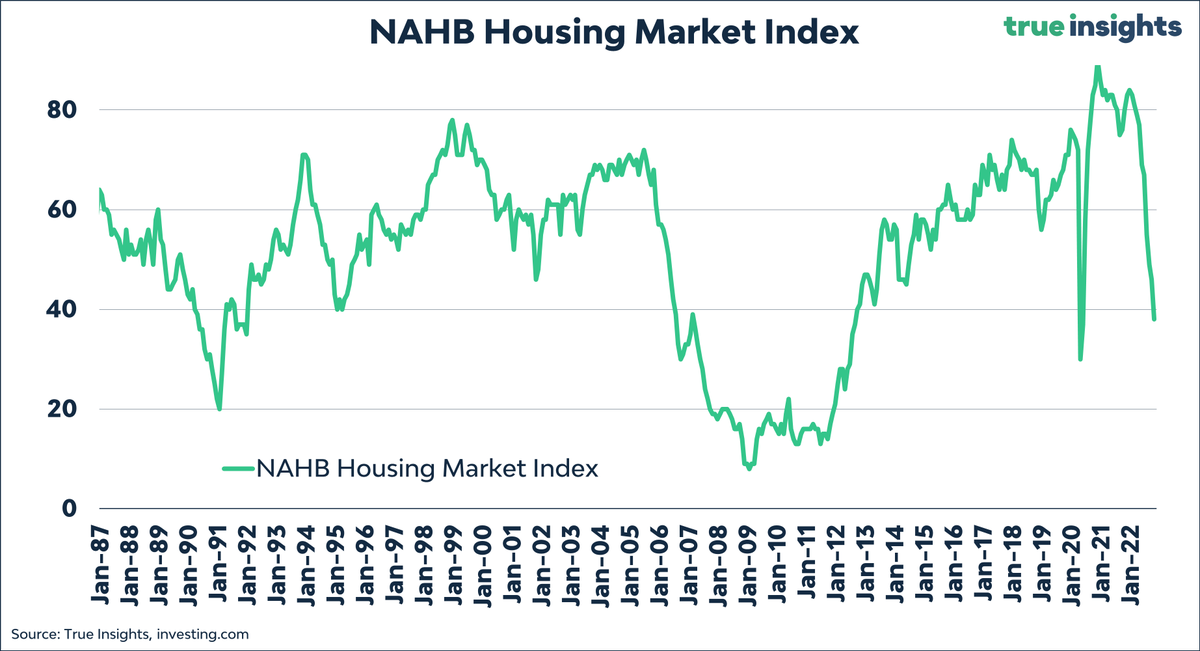

- US homebuilder sentiment is collapsing

- Most downbeat in 10 years, excluding COVID.

- Mortgage rates > 7%

- Inventories highest since GFC

So is it time to buy a homebuilder ETF?

Join True Insights and find out

Let's invest together!