Nicholas Stern

@lordstern1

Professor of Economics and Government & Chair of the Grantham Research Institute on Climate Change and the Environment at LSE

ID:758578173332316160

28-07-2016 08:21:45

163 Tweets

13,6K Followers

15 Following

Follow People

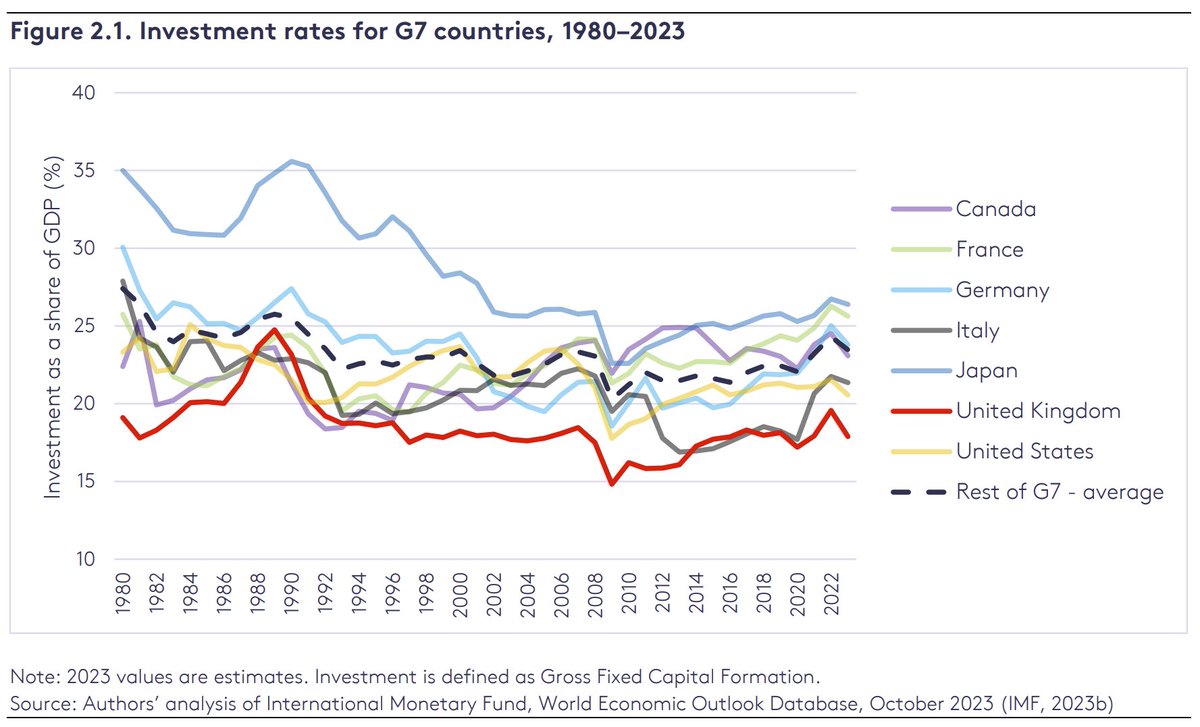

My new article in today's Financial Times: Sustainable investment can lift Britain out of its slump ft.com/content/0c3330…

In the end, COP28 produced “a pretty good agreement… It is remarkable how far we’ve come since the Paris agreement,” says climate expert Nicholas Stern. But, he cautions, “the enforcement is not there. We have to be clear about that.”