Dan Rasmussen

@verdadcap

I am the founder and CIO of Verdad Advisers. Views are my own. Join our email list: https://t.co/jbASQUtki5

ID:957664802150625280

http://www.verdadcap.com 28-01-2018 17:20:56

3,0K Tweets

39,1K Followers

900 Following

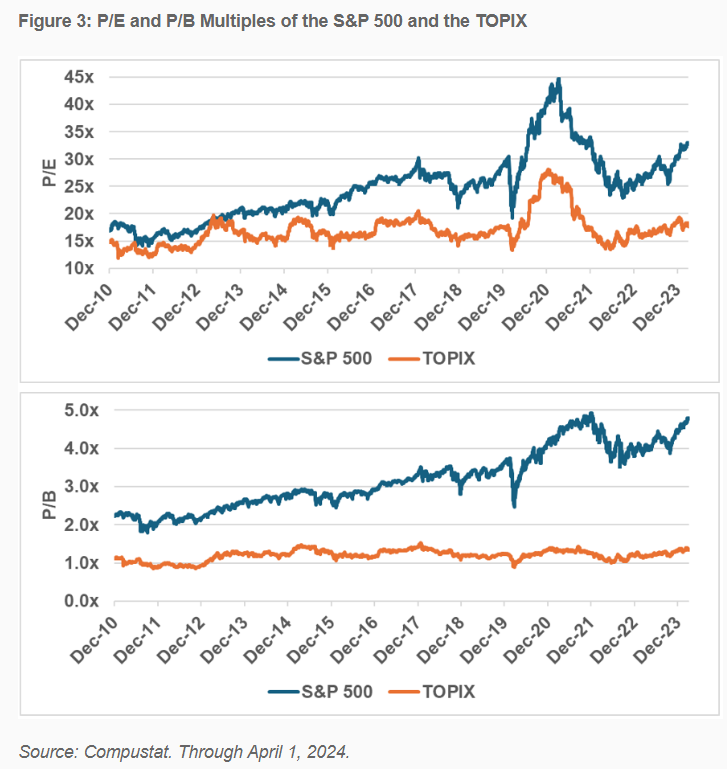

TopTradersLive.com Andrew Beer Here is a chart from Dan Rasmussen doing the rounds on LinkedIn.

Over the last decade, bonds were favored for their ability to move opposite to stocks, but the inflation surge in 2022 showed us that this pattern breaks down when inflation exceeds 3%.

Historical insights…

Interesting stat by Dan Rasmussen on the corporate debt + cash evolution over the years in Japan vs the US.

In the past 25 years, institutional asset managers have radically shifted their portfolios to owning as much as 40% of assets in illiquid private equity.

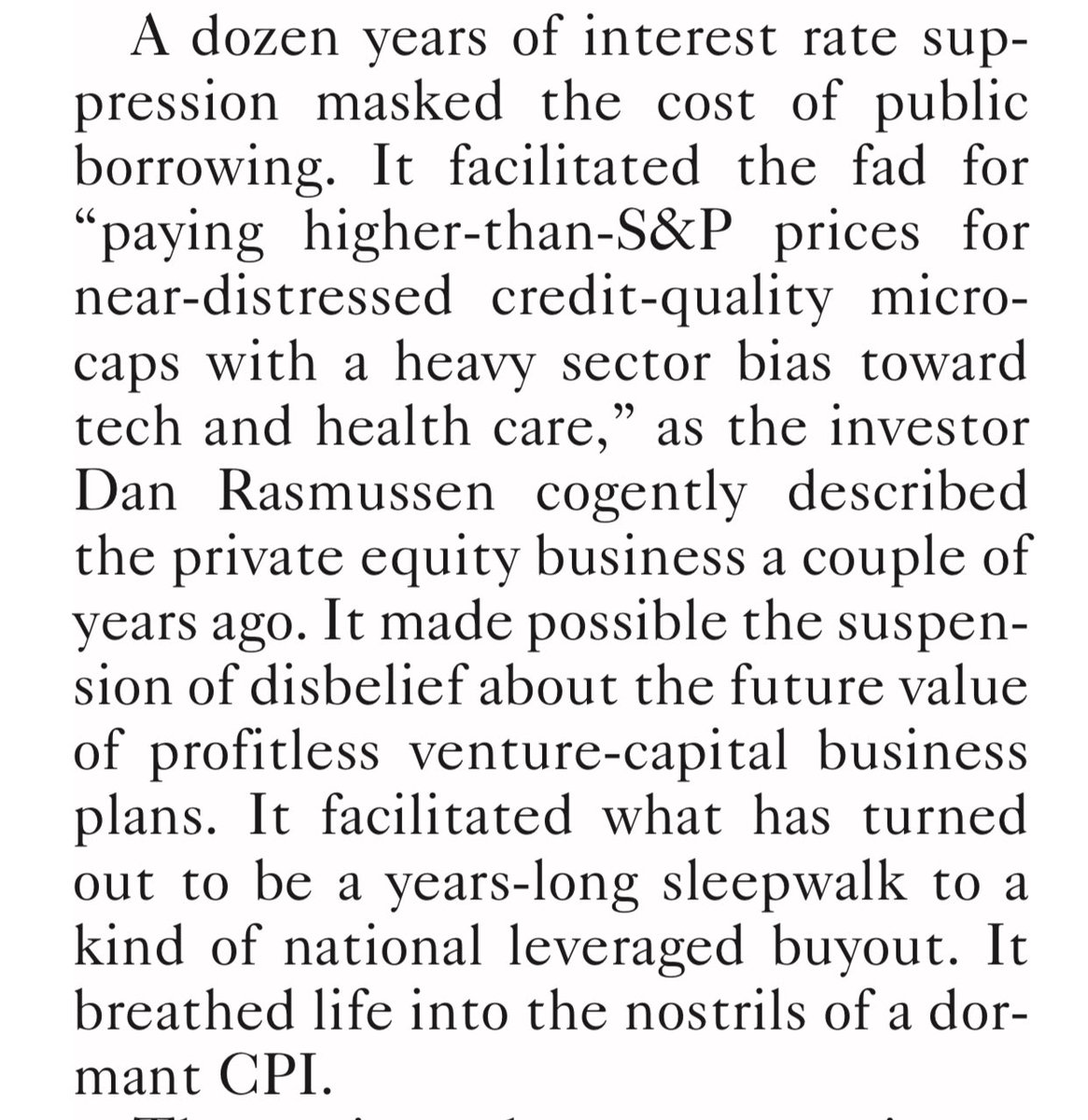

'There's nothing more overbought today than private equity,' said Dan Rasmussen Dan Rasmussen during the Hedgeye Investing…

Really enjoyed my conversation with Oliver Renick on the Schwab Network

schwabnetwork.com/video/expectat…

My review in the WSJ of the Missing Billionaires: An obscure mathematical formula may be the key to building and managing complex portfolios over time. wsj.com/finance/invest… via WSJ Books Section

My review in the WSJ of “How to Listen When Markets Speak” wsj.com/finance/how-to… via WSJ Books Section

Is now the time to put money into alternatives and private equity?

That’s the biggest mistake you can make right now, says Dan Rasmussen Dan Rasmussen. “That’s not safe. It’s the opposite of safe. That’s highly risky.”